The popularity of platform businesses continues to skyrocket due to continued usage growth. This creates the need for businesses such as TaskUs (TASK), a company that provides functional customer service and assistance, to support the rapid scale of such platforms. Today’s FA Alpha Daily will take a look at its as-reported data and present the real profitability of TaskUs and why it deserves to be on the FA Alpha radar.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Platform businesses are all over the headlines for the last decade, and their popularity is increasing every single day.

Even some established companies are shifting focus from their traditional business model to becoming a platform business.

Whatever you think of the embracing of these platform businesses, be they social media platforms, food delivery apps, or ride-sharing services, they all are growing in usage.

That means they all need one thing, functional customer service, and assistance that can scale with them. This is where TaskUs comes in, by providing AI-driven customer experience solutions that can help these businesses with the background of needed business functions.

TaskUs helps to manage customer service and moderate content on social media platforms with a workforce in countries like the Philippines and elsewhere. These are services that would be too prohibitive to bring “in-house,” so TaskUs is called in.

It sounds like a tough job…and also a low-value one based on as-reported metrics.

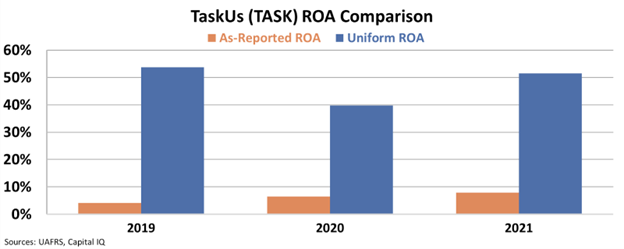

This is because the company’s return on assets (“ROA”) looks well below corporate averages the last few years. In fact, it barely clears the cost of capital.

It’s no wonder then investors have been looking elsewhere for value.

However, this is just the distorting nature of GAAP accounting. Uniform metrics reflect the true profitability of TaskUs. The company has actually been producing massive returns, with an impressive 52% Uniform ROA in 2021.

The company’s strong profitability and its positioning for the growing platform businesses show that it could be a compelling opportunity for investors.

However, it looks like the market is not recognizing the company’s potential as it has a 16x Uniform P/E, well below corporate averages.

The booming demand, high growth potential, impressive returns, and a low Uniform P/E make TaskUs a great FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

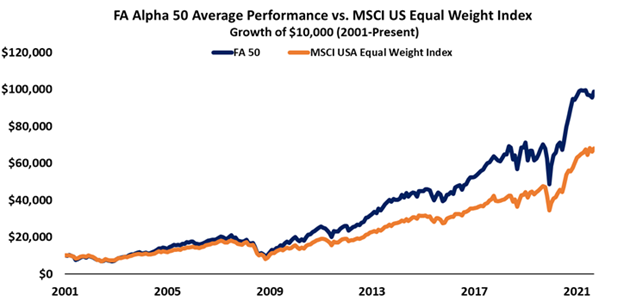

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, TaskUs, Inc. (TASK) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.