In some ways, active investment management is dead, as everyone believes. However, there are exceptions, one of which is Artisan Partners Asset Management (APAM). Despite an active management industry that is crumbling, we will discover in today’s FA Alpha why the market fails to notice APAM’s exception.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

There have been a lot of news and articles lately about the shift to passive investment strategies and how active equity management is dying.

That is true to a very large extent. Actively managed mutual funds constituted 82% of the funds’ total net assets under the management in 2009, while index ETFs and index mutual funds constituted the rest. In 2019, these ratios were 61% and 38%, respectively.

The fund market is only a small part of the whole market. However, these ratios clearly show investors’ preferences.

As many hedge funds fail to generate significant excess returns, investors are becoming more convinced that investing in passive indices is a better idea.

Another reason for this shift is fees. Hedge funds typically charge fees for assets under management and annual performance, whereas index funds and ETFs have very low fees and no performance fees.

However, this does not mean that there are no successful exceptions in the active investment management space. Investors can take advantage of depressed valuations to consolidate the good ones and get value and high returns.

One good example of this is Artisan Partners Asset Management (APAM). The asset management firm invests in public equity, non-investment grade corporate bonds, and secured and unsecured loans across the globe.

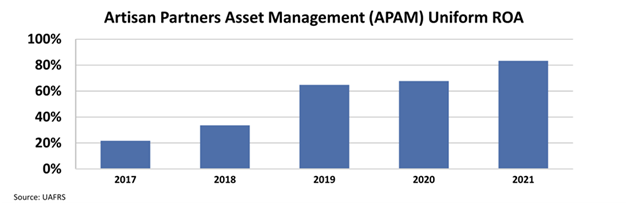

It has managed to increase its profitability immensely over the last five years. The Uniform return on assets (“ROA”) has surged from 21.7% in 2017 to 83.3% in 2021, impressing investors and other fund managers alike.

This jump in profitability is extraordinary. However, the market seems to choose to ignore this improvement because of the general opinion on active investment management firms.

The profitability surge seemed to be recognized between the years 2018 and 2021, as P/E also increased from 5.2x to 9.1x. However, the company is currently trading at a 6.7x Uniform P/E, which is lower than five of the last six years.

Looking at the high growth and astonishing profitability, the market expectations seem too pessimistic. The market fails to realize that Artisan is an exception in a crumbling active management space.

The high growth, impressive returns, and low valuation mean that Artisan Partners is a great company to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

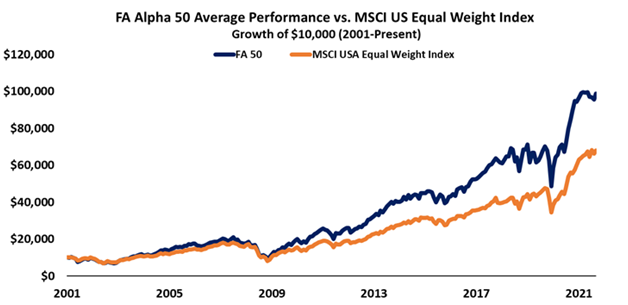

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Artisan Partners Asset Management (APAM) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.