The automotive industry is getting punished by the market due to lower sales volume since the pandemic. However, the market overlooks those innovative companies who can still generate profits amidst declining vehicle sales. In today’s FA Alpha, we’ll look at CarGurus (CARG) to determine what as-reported numbers are missing and see how it generates profit even though the car industry is having a hard time.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Buying a car was all the rage in 2021. Used car prices practically matched new car prices… and in some cases, they were actually higher.

The problem was twofold. With people moving out of cities, demand for cars was off the charts. At the same time, supply chain issues started setting in. Car manufacturers couldn’t make cars fast enough. This year, carmakers are starting to feel the pain of missing out on those sales.

People weren’t willing to wait forever. And now that car production is finally catching up, demand seems to be stalling.

Each month in the first half of 2022 had lower sales compared to the same months in 2021.

Investors are worried about car sales and are punishing companies related to it. They do not realize that those innovating and revolutionizing the industry may be able to still make money.

CarGurus (CARG) is a company that comes to mind when we think about innovating in the car industry. The company operates an online automotive marketplace connecting buyers and sellers of cars.

Investors do not understand the operations of the company and how profitable it can get. This is because they are looking at the distorted as-reported data, which fails to show CarGurus’ real performance.

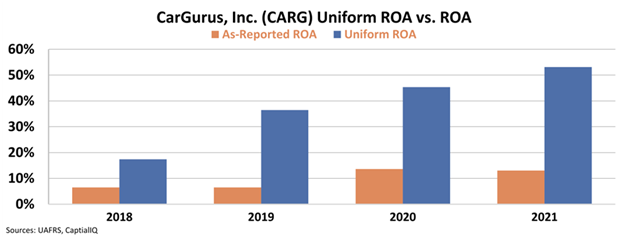

The as-reported return on assets (“ROA”) of the business was only 7% in 2018 and improved slightly to 13% in 2021.

If we clear up the numbers using Uniform Accounting and look at the real data, we see an incredibly different business.

Uniform ROA was much higher than what is suggested by as-reported accounting. It jumped from 17% in 2018 to a massive 53% in 2021.

It seems CarGurus’ ability to innovate proved effective in protecting it against lower sales. In a time when everyone in the industry struggled, its online marketplaces have been minting money.

Additionally, CarGurus is trading at a historical low of 3.4x Uniform P/E, showing that the market is not seeing this big potential yet.

The improving profitability, high growth potential, impressive returns, and a low Uniform P/E meant that CarGurus rose to the top to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

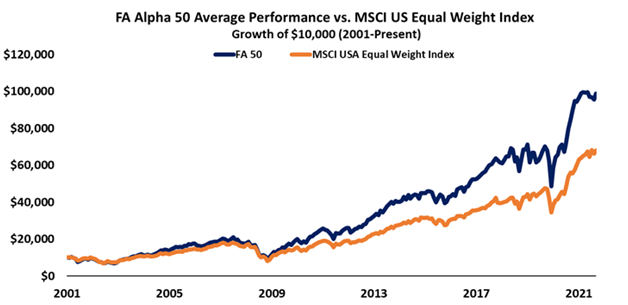

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, CarGurus (CARG) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.