Demand for used cars was perfectly set-up with the pandemic, At-Home Revolution, and shortages of new cars all coming together over the past two years. Today’s FA Alpha Daily will talk about the largest used car retailer in the U.S., CarMax (KMX), and how the market is already priced for CarMax’s tailwinds.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

CarMax (KMX) has had the perfect set-up for the past two years.

Thanks to the pandemic and the At-Home Revolution, people started shopping for cars in record numbers.

A large percentage of people moved out of cities and into the suburbs, where they could no longer rely solely on public transportation. Meanwhile, people still in cities looked for ways to reduce possible exposure to COVID-19, and one of those ways was reducing public transportation use.

With flights being few and far between, and long-distance travel practically non-existent, those with a travel-bug looked for vacation options closer to home.

All this led to a surge in demand for cars.

Meanwhile, this growth in demand for cars was paired with a supply constriction. Shortages of semiconductors—an essential component of modern car production—meant assembly lines ground to a halt. This created an acute shortage of new cars. This meant buyers soon turned to used ones.

For the largest used-vehicle retailer in the country, this became the perfect opportunity to mint money. Everyone flocked to CarMax to buy the cars that filled its lots. And thanks to its strong digital presence, CarMax made it even easier to purchase a used car.

Now, even as things return to normal, cars are still hard to come by. Additionally, there’s the lasting tailwinds from the At-Home Revolution of changing consumption patterns. These trends may be longer lasting than anyone anticipated, which means CarMax is set-up for an impressive run even after the pandemic itself is over.

Yet looking at as-reported metrics, it looks like the market may be asleep at the wheel.

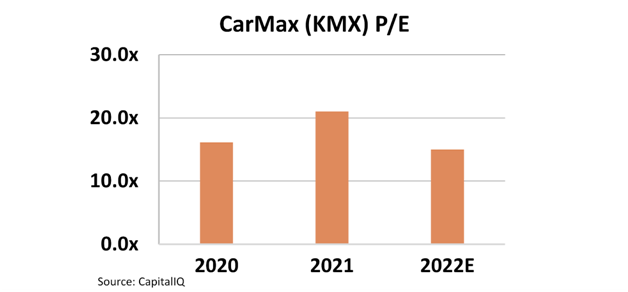

CarMax appears to trade at a modest 15x P/E, 25% cheaper than market average valuations of 20x. For a company thriving in such a hot market, one would expect to see a much higher P/E value, even above averages.

GAAP metrics make it seem that the market is failing to price in the tailwinds CarMax is riding on.

However, Uniform Accounting tells us a different story.

Rather than asleep at the wheel, we can see the market is already aware of CarMax’s tailwinds, as the company isn’t trading at a significant discount after all. It’s currently trading at a healthy 27x P/E, which would make sense for an above average company realizing large tailwinds.

Uniform Accounting makes it clear the market is already pricing these good times to continue for a while.

While CarMax is doing incredibly well, the market already knows that. Investors stuck in the dark may make an investment based on the wrong data, and find themselves on the wrong side of a big trade. It’s only with Uniform Accounting that we can see the reality of where a company is trading.

SUMMARY and CarMax, Inc. Tearsheet

As the Uniform Accounting tearsheet for CarMax, Inc. (KMX:USA) highlights, the Uniform P/E trades at 27.4x, which is above the global corporate average of 24.0x, but below its historical P/E of 29.6x.

High P/Es require high EPS growth to sustain them. In the case of CarMax, the company has recently shown a 14% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, CarMax’s Wall Street analyst-driven forecast is a 64% EPS growth in 2022 and a 3% contraction in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify CarMax’s $107 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 12% annually over the next three years. What Wall Street analysts expect for CarMax’s earnings growth is above what the current stock market valuation requires in 2022 but below that requirement in 2023.

Furthermore, the company’s earning power is below the long-run corporate average. However, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. All in all, this signals a low credit risk.

Lastly, CarMax’s Uniform earnings growth is in line with its peer averages, but the company is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.