The Biden administration is allocating over $500 million to improve infrastructure across the United States, boosting the supply chain supercycle and positioning construction machinery companies, such as Caterpillar (CAT), for higher profitability in the near future. Using the Embedded Expectations Analysis framework, today’s FA Alpha Daily will dig into what investors can expect from Caterpillar.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

When President Biden came into office, one area he expressed a desire to devote resources to was improving infrastructure across the United States.

The Infrastructure Investment and Jobs Act has committed over $500 billion dollars to upgrading roads, bridges, public transportation, and myriad other projects in the coming years.

This act will further boost the supply chain supercycle that the economy is seeing.

Investments in infrastructure and optimizing supply chains signal that companies such as Caterpillar (CAT) and other players in the construction industry are set to profit in the near future.

Caterpillar is one of the world’s largest construction machinery companies. Its large yellow trucks, forklifts, and excavators are highly recognizable, and make an appearance on almost every construction site you see.

With sales of nearly $25 billion, it’s 25% percent larger than its next biggest competitor, Komatsu (KMTUY). Thanks to its huge market share, it creates all of the relevant construction machinery for any industry, so it will be exposed to some part of the supply chain supercyle wherever it emerges.

Traditionally, construction materials is a highly cyclical industry, which leaves investors hesitant to buy in. However, now is when the company is set to take off, due to the explosive demand that will come as a result of the Infrastructure Act.

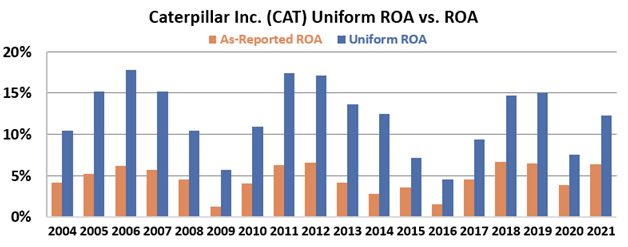

Looking at historical figures, Caterpillar enjoyed peaks in its return on assets (“ROA”) in 2006, 2011, and 2019. These were all the high end of industry cycles. During these years Caterpillar saw Uniform ROA’s of 18%, 17%, and 15%, respectively.

At the height of the cycles for construction, Caterpillar saw returns higher than the corporate average of 12%.

After a dip in returns in 2020, Caterpillar bounced back in 2021 and looks primed to reach another peak in the coming years.

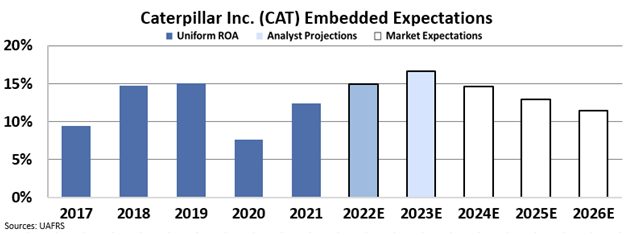

However, with our Embedded Expectations chart, we can see a strong mismatch between analysts and market expectations. Wall Street analysts who study the company project return to climb as the next cycle gains momentum.

Analysts are understanding the huge potential tailwinds in the business and expect returns to grow accordingly. Meanwhile, despite the huge potential tailwinds of the supply chain supercycle, the market is expecting the company’s returns to revert to levels below corporate average.

The coming infrastructure cycle will potentially reap great benefits for Caterpillar. Based on the power of Uniform Accounting and Valens’ Embedded Expectations Analysis, it is clear to see that the market is overlooking its potential.

If Caterpillar is able to execute at levels it has in the past going into this wave of historic infrastructure and supply chain spending, the market will be surprised and the stock price will follow.

SUMMARY and Caterpillar Inc. Tearsheet

As the Uniform Accounting tearsheet for Caterpillar (CAT:USA) highlights, the Uniform P/E trades at 17.4x, which is around the global corporate average of 19.3x, but below its own historical P/E of 22.1x.

Average P/Es require average EPS growth to sustain them. In the case of Caterpillar, the company has recently shown a 69% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Caterpillar’s Wall Street analyst-driven forecast is 31% and 10% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Caterpillar’s $198 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings need to grow immaterially per year over the next three years. What Wall Street analysts expect for Caterpillar’s earnings growth is above what the current stock market valuation requires in 2022, but below its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are below total obligations—including debt maturities, capex maintenance, and dividends. All in all, this signals low dividend and credit risk.

Lastly, Caterpillar’s Uniform earnings growth is below its peer averages, but the company is trading near its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.