With the impending supply chain Supercycle in the United States, companies ramp up reinvesting capital in CAPEX. This booming demand benefits companies such as Caterpillar (CAT), one of the world’s largest machinery producers. However, the as-reported ROA does not appear to take into consideration this trend, undervaluing the company. Today’s FA Alpha will look at true profitability and performance through the lens of Uniform Accounting.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

One of the world’s largest machinery producers, Caterpillar (CAT), reached a settlement with the Internal Revenue Service (IRS) over a dispute regarding taxes between the years 2007 and 2016.

It ended up paying about $740 million. Caterpillar and its shareholders can now take a deep breath after putting this 15-year tax battle behind it.

The company will continue to focus on what it does best, being an essential supplier to the needs of those investing in capex.

Caterpillar is already at the heart of the supply chain supercycle we’ve been discussing for some time. The U.S. has gone as long as it can without reinvesting in supply chains. However, now it starts to gain pace as the supply chain issues started to affect the customers directly.

Companies are bringing their manufacturing facilities back home and renewing the infrastructure to make supply chains more efficient and resilient.

This ramp-up in investments means more contracts and higher demand for the company’s products. We think the supply chain supercycle is going to be a big wave for the next decade, therefore this booming demand is going to be sustainable.

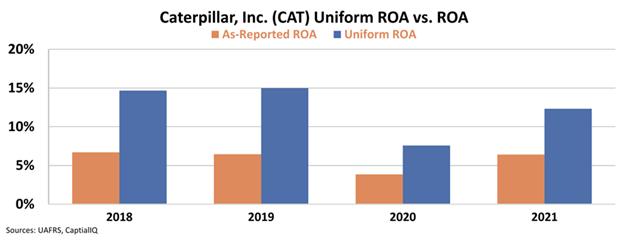

However, the as-reported metrics don’t really tell this story. Investors looking at as-reported profitability metrics would think that the market doesn’t care about the settlement or the supply chain investment trend, as ROA even at the best times was only 6%.

As seen in the chart below, Caterpillar’s as-reported ROA dropped from 6% in 2019 to 4% in 2020, being impacted negatively by the pandemic. The profitability recovered a little, surging back to 6% in 2021.

However, this picture of the company’s profitability is inaccurate. This is because of the distortions in as-reported accounting and can be fixed by making the over 130 adjustments necessary under Uniform Accounting.

Looking at the cleared numbers, we realize that Caterpillar’s profitability is much higher than what the as-reported numbers suggest.

The company’s Uniform ROA was more than double the as-reported one in 2019, standing at 15%. The pandemic hit it hard and it dropped to 8%, before jumping back to 12%.

Uniform ROA in the worst year was higher than the as-reported ROA in the best year looking at the last 4 years.

Uniform Accounting clears the numbers and lets investors see how the company is so crucial for capex and supply chain investments is in fact much more profitable than the cost of capital levels.

As these investments continue and with the long tax battle behind, Caterpillar will have more of those “good years” when it had a ROA of more than 10%. As these years last longer, there is going to be a higher upside potential.

SUMMARY and Caterpillar Inc. Corporation Tearsheet

As the Uniform Accounting tearsheet for Caterpillar Inc. (CAT:USA) highlights, the Uniform P/E trades at 18.1x, which is around the global corporate average of 17.8x, but below its historical P/E of 22.2x.

Average P/Es require average EPS growth to sustain them. In the case of Caterpillar Inc., the company has recently shown a 69% increase in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Caterpillar’s Wall Street analyst-driven forecast is a 42% and 7% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Caterpillar’s $228 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 2% annually over the next three years. What Wall Street analysts expect for Caterpillar’s earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 70bps above the risk-free rate.

All in all, this signals average dividend risk.

Lastly, Caterpillar’s Uniform earnings growth is above its peer averages and in line with average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.