Despite Great Lakes Dredge & Dock Corporation (GLDD) being in prime position to take advantage of near-shoring and port expansions, credit rating agencies gave it a B rating. Today’s FA Alpha Daily will examine the company’s real creditworthiness.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Rising oil prices have received much attention in recent months, for good cause, as oil is essential in making the global economy run.

As oil has been making its round in recent months in the media, more data has come out about the true extent of supply constraints we are facing right now.

And therein lies a key development. We have more data about an issue at hand and can make more informed decisions as a result of it.

One of the biggest waves over the past decade is the idea that it’s not just crude that powers the world today.

The “oil” that runs the modern world is also data.

This data, once refined and analyzed, powers much of the modern economy.

With so much emphasis put on data, it becomes no surprise that companies that are at the heart of this transformation are thriving.

Equifax (EFX) has been a leader in this space, and because of that, S&P has fallen in love with the name, and given it a lease to borrow tons of debt.

S&P, ignoring the company’s credit structure, gives it a BBB rating with a very low risk of default.

However, we can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

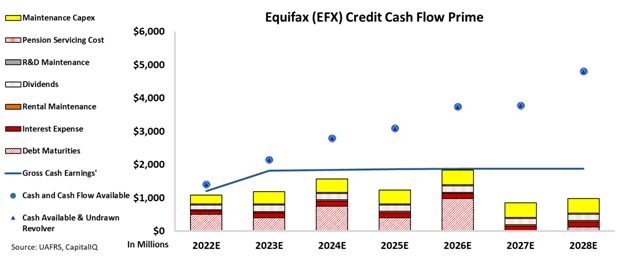

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As evidenced by the following chart, Equifax has a much riskier credit profile due to constant debt maturities going forward.

This is why, due to constant debt maturities occurring over the next several years, we have rated the company a riskier HY2- rating.

Rating agencies seem to be getting caught up in the demand for data in the global economy, and in doing so are missing what the data is showing them about Equifax’s risk.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Equifax Inc. Tearsheet

As the Uniform Accounting tearsheet for Equifax Inc. (EFX:USA) highlights, the Uniform P/E trades at 25.9x, which is above the global corporate average of 20.6x, but below its historical P/E of 29.8x.

High P/Es require high EPS growth to sustain them. In the case of Equifax, the company has recently shown a 69% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Equifax’s Wall Street analyst-driven forecast is for a 9% EPS decline in 2022 and a 15% EPS growth in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Equifax’s $173 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 5% annually over the next three years. What Wall Street analysts expect for Equifax’s earnings growth is below what the current stock market valuation requires in 2022 but above in 2023.

Furthermore, the company’s earning power in 2021 is 11x the long-run corporate average. However, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. In addition, intrinsic credit risk is 150bps above the risk-free rate.

Overall, this signals a moderate credit and dividend risk.

Lastly, Equifax’s Uniform earnings growth is below its peer averages, but the company is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Equifax Inc. (EFX) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.