With people developing new hobbies during the pandemic, Cricut (CRCT) witnessed a strong demand for its crafting machines and materials. Today’s FA Alpha Daily will highlight the profitability of the FA Alpha 50 name.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

With people spending more time at home in the past two years, there’s been more time to try out new hobbies. While some were passing fads, many have ‘stuck’ and are now influencing spending patterns to this day.

Many companies saw a huge spike in pandemic demand, but sales were merely ‘pulled forward’ before returns collapsed today. One example could be home theater suppliers like Sonos (SONO). After everyone bought a home theater setup to watch movies, they won’t be spending with the company again until upgrading.

However, a lot of companies involved don’t just sell a hobby product, but also all the supplies to go along with it. This means they can keep making money long after the pandemic is over.

One of those companies that saw a sustainable increase in demand during the pandemic is Cricut (CRCT).

Cricut makes crafting machines and materials for those who want to craft in a “smarter” and more technologically driven way.

Its products include electronic cutting and design machines that are used to cut a variety of materials, like paper, vinyl, and even wood. Popular projects include designs for t-shirts, greeting cards, and stickers.

Cricut also sells a variety of accessories and materials to go along with its machines, as well as a compatible cloud-based subscription design service that 33% of its users are subscribed to.

With Cricut, there are endless options for crafting, which is what gets users hooked so easily and keeps them coming back for more supplies.

The pandemic was a catalyst that has fueled stronger demand for Cricut, which now has a fanfare following.

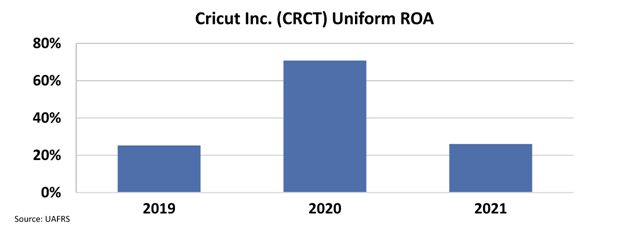

Its return on assets (“ROA”) spiked from 25% in 2019 to 71% in 2020, as more people bought the machines to keep themselves busy during the pandemic.

ROA has since dropped to 26% in 2021, but it doesn’t mean its profitability is going away any time soon. It’s using this increase in returns to help itself grow.

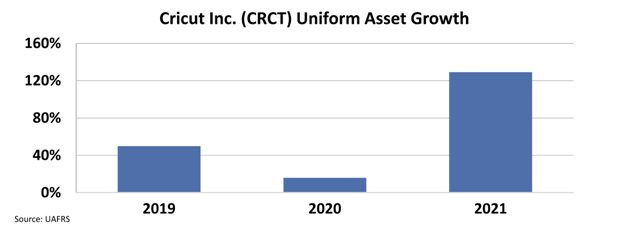

In 2021, Cricut saw impressive asset growth of 129% to expand its manufacturing base to keep up with repeat customer demand.

Over time, Cricut should be able to leverage its investments to continue to expand its service to more customers and improve its returns.

Yet the market doesn’t seem to understand that the demand for Cricut’s products won’t be going away any time soon. Cricut currently trades below market averages at just a 15.8x Uniform P/E. Once people buy the initial machine, they must keep replenishing all the supplies and accessories to go along with it, which should keep demand elevated in the years to come.

That low valuation, combined with its explosive growth in 2021 and strong profitability, makes it a compelling company and an interesting FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

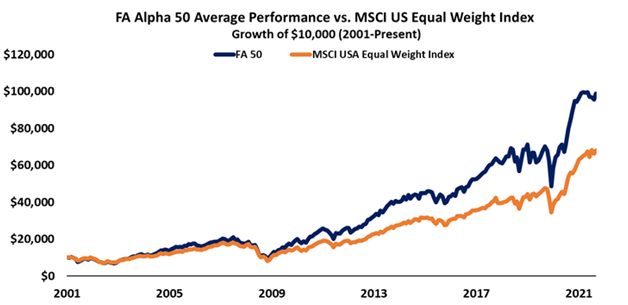

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here to learn more.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Cricut Inc. (CRCT), is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.