Most experts seem to believe that it’s no longer a matter of if a recession is coming, but a matter of when. Today’s FA Alpha Daily will explore the behavior of the stock market back in the 1949 recession to learn the appropriate investment strategy in the looming engineered contraction.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

If we look at all the data that matters, it’s clear this recession is different from 2008 or the Great Depression. This is a ‘recession in name only’ (RINO), not a real recession.

Many of the most important indicators you look at to signal a recession, from credit standards and defaults to employment data, all point to a healthy economy, and one that is even still a little too hot.

At this point, the majority of economists think that a recession will come in 2023. More than half say it will start in the first half of the year.

Whether in the first or second half of 2023, most experts seem to believe it’s no longer a matter of if a recession is coming. It’s a matter of when.

Recall that much like now, the Fed raised rates in 1947 in an attempt to rein in post-war inflation, which was caused by supply-chain issues and surging consumer spending.

It worked.

Within six months, inflation had been cut in half. A year later, it was below 5%… down by more than two-thirds.

But a little more than 18 months later, the other impact of higher rates came home to roost. The Fed was so successful at cooling things off that in 1949, the economy tipped into a recession.

However, it wasn’t the epic economic collapse you might be picturing. The 1949 “recession” was nothing like the Great Depression or the 2008 financial crisis.

This dip was much milder. Gross domestic product (“GDP”) growth was negative in the first two quarters. It fell 1.4%, then another 0.3%.

Default rates rose, fueling the recession. But they didn’t explode.

A total of 0.8% of all Moody’s-rated borrowers defaulted. For context, in the midst of the Great Depression in 1933, that number was 8.4%. And it was 5.4% in 2009.

Unemployment rates sat between 3.5% and 4% from 1946 to 1948. By mid-1949, it was above 6%. And after peaking briefly at 7.9% that October, it ended the year at 6.6%.

This was hardly a devastating economic mess. The Fed did its job. It engineered an economic cooldown so well that we even briefly saw a deflationary period. When the glut of pent-up savings washed away, prices actually fell from May 1949 to June 1950.

In fairness, if you’d bought stocks in mid-1948, you’d have been down 15% by the bottom in mid-1949.

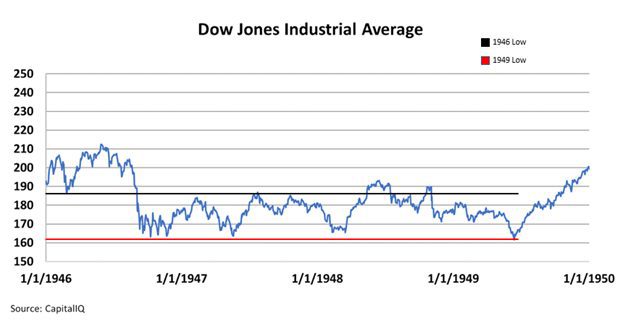

But based on recent history, you’d probably assume that the market tanked in that recession. As you can see in the chart below, that wasn’t the case. The market was range-bound since inflation exploded in 1946. And it only retested the low of that range.

Once inflation spiked, the market immediately decided that a downturn was inevitable. Either the Fed would raise rates and force a recession to tame inflation… or inflation would run rampant.

Said another way, the market baked in the Fed’s actions ahead of time – and then basically watched the data. When things started to look better, the market rallied between the low of 160 and the high of 190. When economic data got worse, the market sold off.

Strategic investors who stayed in the right industries fared the best. Transportation stocks got crushed, while utilities did well. So did industrials, thanks to investment in rebuilding factories to meet demand.

This was a market where themes mattered… and where tactical investing mattered as well.

If we expect history to repeat – as opposed to just rhyming, which is generally the case – we’d be looking at a recession 18 months from the Fed’s first rate hike. That would bring us to late third-quarter 2023.

The data backs that up. The debt load for companies is nothing to worry about now, but could become a problem in early 2024. If interest rates remain stable through late 2023, when companies start looking to refinance, it could spell trouble.

Companies will need to pay twice as much in financing costs as they did in late 2019 and early 2020. For the most part, corporations have plenty of cash on hand and enough cash flow to handle these issues. But it might be enough to tip over the weakest borrowers.

Just like in 1949, the Fed is certainly focused on taming inflation this time around. It will engineer whatever kind of economic “landing” it needs to get inflation under control.

This means if the numbers don’t come down in the next three to six months, the Fed will continue to raise rates until inflation starts to crack. And that points to a potential recession in late 2023 or early 2024.

And yet, much like in the late 1940s, that doesn’t mean the market has to crash further from here. After the drop we’ve seen this year, investors may already be pricing in the potential for a recession.

They’re just waiting to see what will really happen.

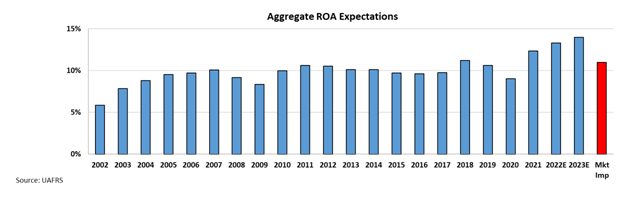

We know this because of how low their expectations are for Uniform return on assets (“ROA”) going forward.

The chart below shows past ROA for U.S. public companies reached 12% in 2021. And in 2022, that number is forecasted by analysts to be even higher.

However, with the Fed looking to slow the economy and inflation, ROA may not explode as much as analysts expect. But the market is not pricing that in.

The market is already pricing in the sort of drop in returns that we only see in a recession. From 2007 to 2009, ROA fell by 200 basis points. The same thing happened from 2018 to 2020. And that’s what the market is pricing in from 2022 on.

So if history repeats, the market is already pricing that in.

Investors don’t need to worry about the floor dropping out from under them. This next recession isn’t going to be a world ender. We believe we’ll see a milder Fed-engineered contraction.

If that happens, get ready for a sideways market for the next year and a half.

Investors will need to be tactical. You’ll need to zero in on the few themes and industries that could buck this trend.

But that’s only if history repeats itself. If history rhymes, there’s another potential path the markets could take. Next week, we’ll discuss what to expect if the recessionary clouds start to clear.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, get access to FA Alpha Pulse.