Credit rating agencies give Eversource Energy an A- credit rating, but do not realize the risks of the company’s effort to boost investments in alternative energy sources. Today’s FA Alpha Daily will explore the true risks of doing so through the Credit Cash Flow Prime.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Energy and other utilities are essential facilities in every economy. They are the services that make society function at the most basic level.

Historically, they have been stable businesses with somewhat of a captive market since everyone needs energy. Because they’re “mission-critical” though, they aren’t allowed to run purely for profit.

Utilities are heavily regulated to make sure they keep prices fair without risking the health of our energy grid for competitive reasons. That’s why the government treats utilities like “regulated monopolies” that are allowed to own a geographic area but aren’t allowed to charge whatever they like.

Utilities are pretty much guaranteed to cover their costs, and the government sets an “earnings cap” that dictates how much profit they are allowed to make. This cap is specific for each company based on how much it costs to run and invest in the business.

This makes utility stocks incredibly stable, and their earnings are typically distributed as attractive dividend yields.

As such, energy utilities are often considered among the closest you can get to a bond while still investing in the stock market.

The earnings cap we mentioned is partly calculated based on how a utility thinks it’s going to invest in the business, so that’s a big reason why utility companies keep on investing.

For mature utilities like Eversource Energy (ES), most of their spending has historically been on adding new electrical wires or other safe investments that add more continuity or power output.

As a result, credit rating agencies have historically awarded Eversource a fairly safe A- credit rating.

However, we can figure out the true risk by examining it through the lens of Credit Cash Flow Prime.

Interestingly, taking a look at Eversource’s recent investments, investors may question if this is the same stable company that has reliable return horizons that they have been used to.

Instead, its recent investment patterns have seen a lot more investments in renewable energy projects that have longer payback periods and more uncertainty in general.

Furthermore, there is a lot more work to do to build out projects such as offshore wind infrastructure. With Eversource investing heavily to hit its goal of carbon neutrality by 2030, it has been pressing its balance sheet pretty hard in the process.

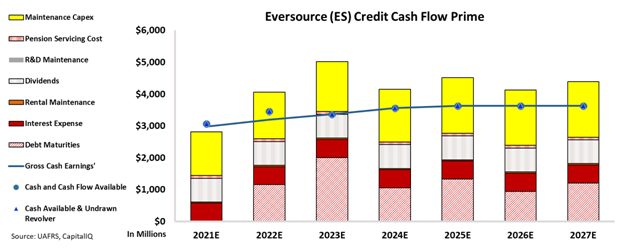

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

It has funded a lot of their projects with debt, and we see a lot of it coming due in the next five years when looking at the CCFP.

S&P’s A- credit rating isn’t reflective of Eversource’s creditworthiness, but rather a sign of the rating agencies overestimating its stability.

That’s why we rate Eversource as a much lower HY2+ grade credit, and with continued uncertainty around its investment horizons, this could be even lower.

Eversource is yet another company where credit rating agencies don’t capture the complete story. While we at Valens recognize the flaws with traditional credit ratings, many creditors do not. The A- credit rating is overly optimistic and fails to paint the issues the company has. As a result, it rates the company as much safer than it is.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Eversource Energy Tearsheet

As the Uniform Accounting tearsheet for Eversource Energy (ES:USA) highlights, the Uniform P/E trades at 38.9x, which is above the global corporate average of 24.0x, and in line with its historical P/E of 40.7x.

High P/Es require high EPS growth to sustain them. That said, in the case of Eversource, the company has recently shown a 7% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Eversource’s Wall Street analyst-driven forecast is for a 26% and 12% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Eversource’s $87 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 16% over the next three years. What Wall Street analysts expect for Eversource’s earnings growth is above what the current stock market valuation requires in 2022, but below the requirement in 2023.

Furthermore, the company’s earning power in 2021 is below the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. Also, intrinsic credit risk is 250bps above the risk-free rate. All in all, this signals a high dividend and credit risk.

Lastly, Eversource’s Uniform earnings growth is well above its peer averages, and the company is also trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Eversource Energy (ES) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.