The FA Alpha Daily provides you with insights and tools to help you build your business.

Our credit analysis highlights strategies for your clients’ portfolios and important talking points for your client discussions – points that the mainstream financial media almost always miss.

We hope you find today’s useful.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Years ago, local radio stations used to have a monopoly on the social lives of entire countries. Radio stations were how everyone discovered new music or received news before the invention of the television. Even over the past 30 years, radio is how folks have entertained themselves while they were driving, working or doing anything with their hands.

Now, the world of entertainment and music has totally flipped on its head. Listeners are turning to options like streaming or XM satellite radio for music, and artists are using these free platforms for publicity rather than a source of income.

In the world of entertainment, the podcast or internet hosted talk show has swept in as the audio entertainment of choice.

It is no wonder then that many assume radio is dead.

Which is why companies like iHeartMedia (IHRT), a massive owner of radio stations, are written off for dead. Certainly the rating agencies view it as such, rating the company as a B credit rating with high risk of bankruptcy in the next few years.

However, we view things differently here at Valens.

Rating agencies have missed how iHeartMedia has been working to consolidate the industry, reducing costs by sharing broadcasting content and negotiating with artists. This means Uniform returns have consistently been double digits over the past fifteen years.

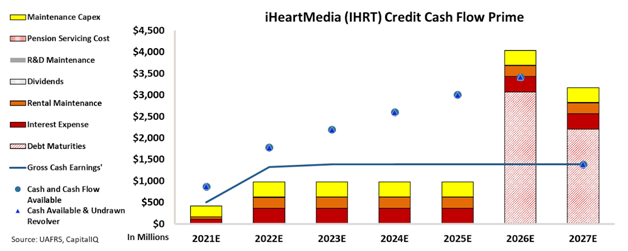

These returns translate to strong cash flows. Using our Credit Cash Flow Prime (“CCFP”) framework, we can get to the heart of iHeartMedia’s true fundamental credit risk.

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As you can see, iHeartMedia is able to cover all of its operating obligations with its cash flows by around $400 million over the next four years. Furthermore, it is building a sizable amount of cash on its balance sheet which is enough to cover its 2026 debt maturities.

With its sizable cash reserves and long runway, iHeartMedia should be able to refinance this debt load into more manageable pieces without creditors fearing for their loans.

This is why S&P’s B high-yield rating for iHeartMedia does not reflect reality. Instead it highlights Wall Street’s blindness to true credit risk.

That’s why we rate the company as having a much lower risk with an investment-grade rating of IG3-, which corresponds to a default rate of less than 2%.

Using Uniform Accounting, we can see through the distortions of as-reported numbers to get to the true fundamental credit picture for companies in transition such as iHeartMedia.

To see Credit Cash Flow Prime ratings for thousands of other companies we cover, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and iHeartMedia, Inc. Tearsheet

As the Uniform Accounting tearsheet for iHeartMedia, Inc. (IHRT:USA) highlights, the Uniform P/E trades at 11.5x, which is below the global corporate average of 24.0x and its historical P/E of 18.5x.

Low P/Es require low EPS growth to sustain them. In the case of iHeartMedia, the company has recently shown a 10% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, iHeartMedia’s Wall Street analyst-driven forecast is a 38% decline in 2021 and a 545% growth in 2022.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify iHeartMedia’s $21 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 10% annually over the next three years. What Wall Street analysts expect for iHeartMedia’s earnings growth is below what the current stock market valuation requires in 2021 but above that requirement in 2022.

Furthermore, the company’s earning power is 4x above the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. All in all, this signals a low credit risk.

Lastly, iHeartMedia’s Uniform earnings growth is in line with peer averages but the company is trading above average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of iHeartMedia, Inc.’s credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.