With the uptick in passive investing and the continuous expansion of wealth management services by banking giants, Focus Financial Partners (FOCS) supports smaller firms while allowing them to operate autonomously. Today’s FA Alpha Daily will show this company’s huge profitability.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Wealth management can be a tough field for the smaller players. As the massive banks like JPMorgan Chase (JPM) and Bank of America (BCA) expand their wealth management arms, and passive investing continues to gain popularity, it’s becoming even more difficult for the small, family-owned firms to compete.

That’s where Focus Financial Partners (FOCS) comes into play as a consolidator of wealth management firms.

The company offers a series of value-added services to its partner firms in the wealth management space, including talent management, cyber security, technology management, and business development.

Focus Financial also has a number of client solutions that allow its partners to enhance their service offerings, including cash and credit solutions, portfolio and asset optimization, and valuation services.

Focus Financial Partners combines these services with its scale and capital pool to help partner firms to compete with the big firms like JPMorgan, all while still retaining the ability to operate autonomously.

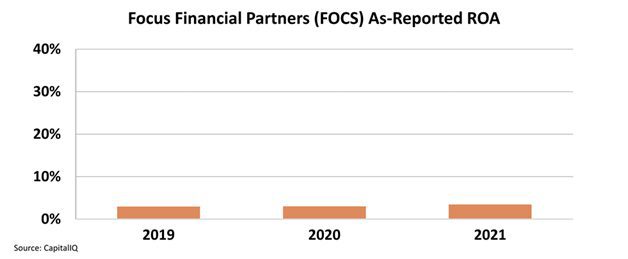

Yet, as-reported metrics lead investors to believe Focus Financial Partners isn’t very profitable.

For the past three years, it appears its return on assets (“ROA”) has been sitting below cost-of-capital levels, at 3% in 2019 and 2020 and only slightly rising to 4% in 2021.

As-reported metrics make it seem like Focus Financial Partners is being left behind alongside the typical small wealth-management firms, and is struggling to compete in an industry dominated by the big banks.

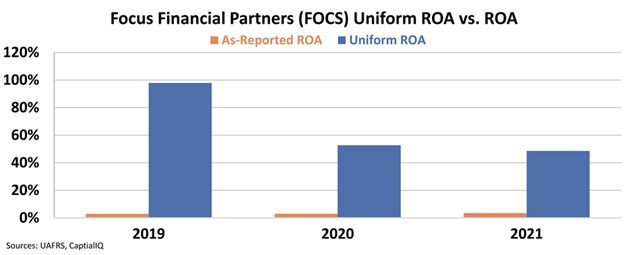

However, Uniform Accounting shows a bit of a different picture.

In reality, Focus Financial Partners has seen massive profitability in recent years. Its ROA spiked at 100% in 2019, and while it has dropped since then, it still remains at a robust 53% in 2020 and 49% in 2021.

Uniform metrics see the value Focus Financial Partners brings to these smaller wealth management shops by allowing them access to the capital and services needed to expand and grow.

While Focus Financial Partners sees this huge profitability, it’s still growing fast and continuing to acquire more partners, adding 24 partners and completing 57 mergers since the beginning of 2019.

However, due to distorting as-reported metrics, the market still isn’t clued into the power of the firm. This is why the company is trading below market average valuations at a 17.4x Uniform P/E.

The combination of Focus Financial Partners’ high returns, strong growth, and below-average Uniform P/E are what make this company so compelling and why it showed up on our FA Alpha 50 screen.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

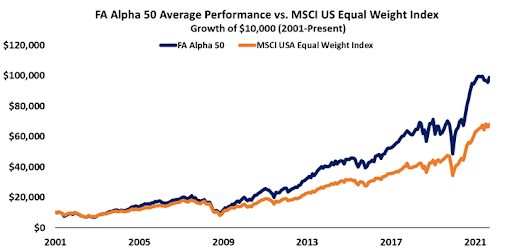

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

If you’re interested in seeing the other 49 names on this month’s FA Alpha, click here to learn more.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Focus Financial Partners Inc. (FOCS), is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.