Headlines about firms’ missed earnings, supply chain disruptions, and inflationary pressures stir up the recession narrative. Today’s FA Alpha Daily will examine U.S. corporate earnings to see the likelihood of a brewing recession.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

We saw plenty of headlines when companies like Target (TGT) and DocuSign (DOCU) missed earnings. Management teams talked about how supply chains and inflation are worse than expected.

Target management said it was sitting on way too much inventory… and margins may fall to just 2% this quarter. DocuSign cut its second-quarter revenue target to $600 million, and shares fell 24% overnight.

It is stories like these that fan the flames of the recession narrative.

There has been a lot of chatter about this earnings season. So, let’s look at the data to understand exactly how bad things are (or aren’t).

Contrary to popular belief, earnings are holding strong.

When folks cherry-pick the worst results, it makes corporate earnings look way worse than reality.

Mind you, supply-chain concerns are significant. Inflation is running rampant. Demand is surging. And labor and materials are in short supply.

But when we take a look at all earnings, they’ve been much stronger than the financial media would lead you to believe.

Companies have been beating earnings at a healthy rate…the same above-average rate of an economy in an extended bull market.

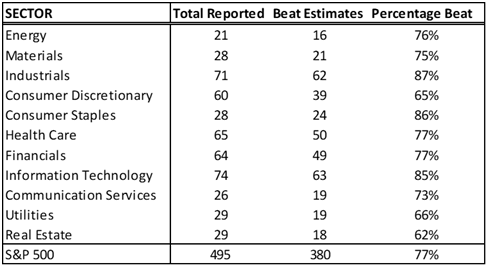

In the past decade, an average of 72% of companies beat earnings estimates. In the first quarter of 2022, that number was 77%.

That’s the eighth-best quarter in the past 10 years. Interestingly, most of the strongest quarters have happened since the onset of the pandemic.

Last year, more than 80% of S&P 500 companies beat expectations. Frankly, last year’s recovery was stronger than folks predicted. But companies are still executing, despite what the headlines say.

You can see that much of the index is doing historically well.

However, the media has locked onto one specific sector and blown it out of proportion. Journalists filled the headlines with fear-mongering about retailers like Target, Lowe’s (LOW), and Home Depot (HD). Consumer discretionary performed worse than every other sector besides real estate.

Meanwhile, looking at a full sector breakdown, you can see why the media didn’t bother talking about industrials… They beat estimates 87% of the time.

Industrials are benefiting from the capex supercycle and their ability to raise costs to match inflation.

By the same token, information technology also had a successful quarter, with 85% of the companies beating expectations.

Even as concerns emerge over the recent tech crunch, it just goes to show that many of these companies’ fundamentals remain strong.

On the other hand, consumer discretionary is being hit the hardest. Headwinds like inflation and the shift to spending on services over goods are hammering the sector.

In this sector, 32% of companies missed estimates. Another 3% met expectations, and only 65% beat them. It’s clear that for many of these companies, the pandemic tailwinds are gone.

These results just go to show that we’re not coming off a struggling quarter. Instead, the winners and losers have simply shifted from the pandemic norm.

If you take the time to delve into the data, you’ll find that the markets remain strong. Contrary to what the headlines show, if you know where to focus, you can still find opportunities to come out on top.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, get access to FA Alpha Pulse.