The FA Alpha Daily provides you with insights and tools to help you build your business.

Our analysis highlights strategies for your clients’ portfolios and important talking points for your client discussions – points that the mainstream financial media almost always miss.

We hope you find today’s useful.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

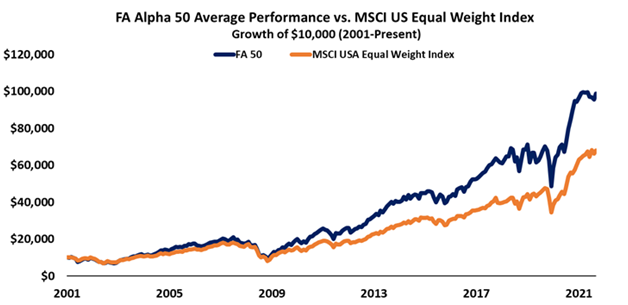

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

For the past decade, cash has been dying.

Payment processors, credit cards, online banking, peer to peer payments, and digital payments have taken over. To keep up with the trend, the US and other developed world central banks even talk about the idea of digital currencies backed by governments.

It’s clear cash could soon be a thing of the past.

So as credit cards dominate, many people think of Visa (V) and Mastercard (MC) as the big winners in the world of digital payments, but there are a lot more out there.

Just as important are the companies that make the transactions happen. The ones that offer the piping the payments ride through in the economy, the point of sales payment solutions, and the players who connect the banks and the card companies with the rest of the financial system and the payment location can’t be forgotten.

One of these big players is Global Payments (GPN), which offers payment technology and services to merchants, issuers, and consumers.

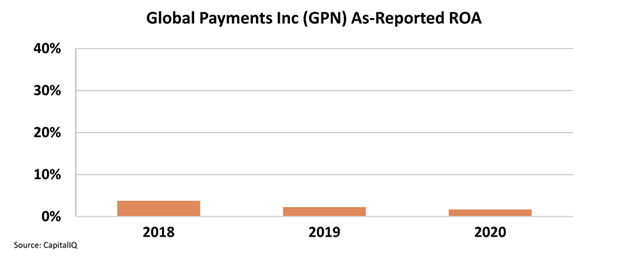

However, as-reported metrics make it appear Global Payments isn’t making much money. It doesn’t carry the name-brand Visa and Mastercard do, and that hurts the market’s expectations.

Over the past three years, return on assets (ROA) decreased from 4% to just below 2% in 2020, making investors believe it is just getting by.

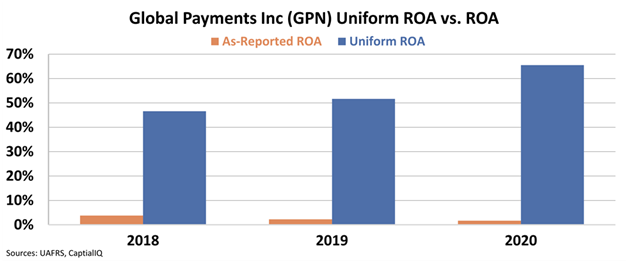

However, Uniform metrics tell us a different story and see the importance of Global Payments’ role as a cog in the payment processing business.

While as-reported metrics make it appear Global Payments’ ROA is decreasing, Uniform metrics point at the opposite to be true.

Instead, ROA has been above 45% for the past three years and is still rising, most recently hitting 66% in 2020.

As the payment processing industry continues to grow, Global Payments is becoming a very profitable company and performing well.

Thanks to the strong industry growth, Uniform Asset growth was an impressive 23% last year.

Meanwhile, Global Payments is still trading at 20x, slightly below market average P/E.

Put all this together and you have a company with impressive profitability, high growth, and low valuations, which is why Global Payments is such a compelling FA Alpha 50 name.

This high-quality market leader in its industry is inexpensively priced and growing aggressively, which is why our FA Alpha Screen discovered the name.

To see the other 49 names on the list, click here.

SUMMARY and Global Payments, Inc. Tearsheet

As the Uniform Accounting tearsheet for Global Payments, Inc. (GPN:USA) highlights, the Uniform P/E trades at 18.9x, which is below the global corporate average of 24.0x and its own historical P/E of 22.4x.

Low P/Es require low EPS growth to sustain them. In the case of Global Payments, the company has recently shown a 12% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Global Payments’ Wall Street analyst-driven forecast is a 6% and 13% EPS growth in 2021 and 2022, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Global Payments’ $141 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow 4% annually over the next three years. What Wall Street analysts expect for Global Payments’ earnings growth is above what the current stock market valuation requires through 2022.

Furthermore, the company’s earning power in 2020 is 11x the long-run corporate average. Moreover, cash flows and cash on hand are almost 3x its total obligations, and intrinsic credit risk is 80bps above risk-free rate, signaling low credit and dividend risk.

Lastly, Global Payments’ Uniform earnings growth is below its peer averages. However, the company is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Global Payments, Inc. is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.