The FA Alpha Daily provides you with insights and tools to help you build your business.

Our credit analysis highlights strategies for your clients’ portfolios and important talking points for your client discussions – points that the mainstream financial media almost always miss.

We hope you find today’s useful.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Back in January and February of 2021, the financial media was completely enraptured by the sage of GameStop. GameStop is a physical video game retailer which has been getting pushed out of the market by Amazon (AMZN) and digital downloads of games straight from the publisher.

Thanks to the company’s dismal credit picture, hedge funds were piling on to short the name, expecting it to go bankrupt and for shares to go to zero.

However, more than 100% of shares were shorted, leading to these hedge funds being forced to buy back shares at higher prices if prices rose high enough for a margin call. When shares started rising, it created a cascading cycle of forced buying to shoot the stock price higher.

While at first, the trading around GameStop seems to be about knowledge of equity, in reality, it reveals an essential truth about investing. All good equity investors need to be good credit investors as well, as the two are inextricably linked.

Both the GameStop bulls and bears were buying stock based on what they knew about the credit health of the business and how long it would last until bankruptcy, not stock valuations.

This can be seen on a macro level as well. Every prolonged crash over the last 100 years has been due to a credit crunch and companies being unable to refinance their loans, leading to widespread defaults.

In the past year, the last company to default has been GameStop. In fact, thanks to sky-high stock prices, the company has been able to refinance its debt using equity issuances.

And yet, all three of the large ratings agencies are rating the name as one in distress with the equivalent of a B rating thanks to the picture of a company failing. This rating translates to a chance of defaulting of over 10%.

We see things differently.

Using our Credit Cash Flow Prime (“CCFP”) framework, we can get to the heart of GameStop’s true fundamental credit risk.

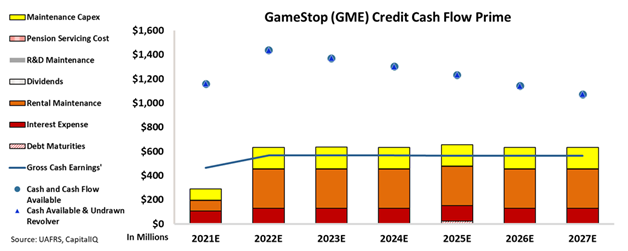

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

As you can see, despite a high amount of rental maintenance, GameStop can cover all of its operating obligations with its cash on hand for the next seven years. This is because its large equity issuances in 2021 provided the company with much-needed liquidity to ride out the near future.

Not only is GameStop not anywhere close to financial troubles, but it also has plenty of capital to invest in its needed business transition away from just selling physical games and into other markets.

S&P’s B high-yield rating for GameStop does not reflect reality. Instead, it highlights Wall Street’s blindness to true credit risk.

That’s why we rate the company as having a much lower risk with an investment-grade rating of IG4+, which corresponds to a default rate of less than 2%.

Using Uniform Accounting, we can see through the distortions of as-reported numbers to get to the true fundamental credit picture for companies in transition.

To see Credit Cash Flow Prime ratings for thousands of other companies we cover, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and GameStop Corp. Tearsheet

As the Uniform Accounting tearsheet for GameStop Corp. (GME:USA) highlights, the Uniform P/E trades at 175.9x, which is well above the global corporate average of 24.0x and its historical P/E of 145.6x.

High P/Es require high EPS growth to sustain them. That said, in the case of GameStop Corp., the company has recently shown 274% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, GameStop Corp. Wall Street analyst-driven forecast is for a 57% and 192% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify GameStop’s $106 stock price. These are often referred to as market embedded expectations.

Meanwhile, the company’s earning power in 2021 is below the long-run corporate average. However, cash flows and cash on hand are 2x its total obligations—including debt maturities and capex maintenance. Additionally, intrinsic credit risk is 80bps above the risk-free rate. All in all, this signals a low credit and dividend risk.

Lastly, GameStop’s Uniform earnings growth is below peer averages, but the company is trading well above peer average valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of GameStop Corp’s credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.