The FA Alpha Daily provides you with insights and tools to help you build your business.

Today’s analysis highlights Uniform Accounting-based insights that mainstream media likely misses, as well as important talking points for your client.

We hope you find it useful.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

As we last covered a few days ago, the U.S. is poised to see a huge capex cycle for the first time in almost two decades thanks to its historically old property, plant, and equipment.

In order for companies to stay relevant, they will need to invest in modernizing their facilities to make them smarter and more efficient. With PP&E so old after the Great Recession and then the pandemic which pushed off reinvestment, companies will all be upgrading at the same time.

As ESG is becoming an increasingly important factor for businesses and investors alike, one of the primary areas that companies will seek to get ahead of competitors and unlock savings is in the world of HVAC.

HVAC may feel like a mundane area of investment for manufacturing and commercial businesses. Today, management teams are looking at how to connect their offices to the web through the internet of things (IoT). However, HVAC investment can be one with ESG and the IoT at the same time.

It also happens to be where Johnson Controls International (JCI)’s building solutions and set of offerings are setting itself up as a major winner of the coming capex cycle. The company offers HVAC solutions from smarter internet-connected systems to outsourced operations that manage heating and cooling for customers.

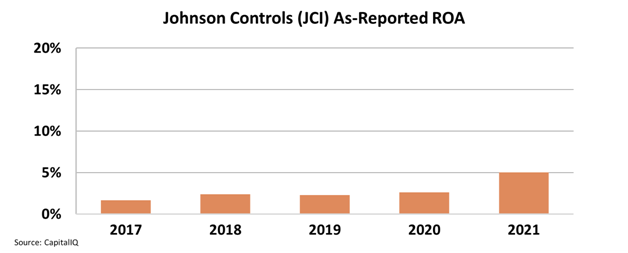

Looking at as-reported metrics, though, it appears the company has only recently been able to capitalize on this opportunity in 2021.

However, investors also wouldn’t be faulted if they didn’t jump at the opportunity to invest in the company today. Even accounting for the jump in 2021, as-reported ROA only jumped from a paltry 3% to a still weak 5%.

With tailwinds as strong as the past year in the IoT and corporate spending, there appears to be no reason to rush to invest.

However, Uniform Accounting tells a bit of a different story.

With a closer look, Uniform metrics show that Johnson Controls’ ROA has been rising and even reached crested 15% over the past two years, surpassing historical returns for the company.

They have been building a dominant position in their field, with a ROA consistently above 10% for the last three years. Returns have consistently been improving since they bottomed out in the middle of the decade.

Surging demand means that Uniform ROA is forecasted to spike even higher to nearly 30% over the next two years as a result of this massive capex cycle.

With the nation continuing to steamroll ahead with its capital expenditures, Johnson Controls is well-poised to take advantage.

So as the country looks to find savings and operational efficiency gains, Johnson Controls International will be right alongside the industry, if not ahead of some of the best companies out there.

It points to just how valuable being in the building solutions space is right now, especially in the underappreciated areas such as HVAC.

SUMMARY and Johnson Controls International plc Tearsheet

As the Uniform Accounting tearsheet for Johnson Controls International plc (JCI:USA) highlights, the Uniform P/E trades at 24.4x, which is in line with the global corporate average of 24.0x and its own historical P/E of 24.6x.

Moderate P/Es require moderate EPS growth to sustain them. In the case of Johnson Control, the company has recently shown a 22% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Johnson Control’s Wall Street analyst-driven forecast is a 107% and 21% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Johnson Controls’ $67.47 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 14% annually over the next three years. What Wall Street analysts expect for Johnson Controls’ earnings growth is below what the current stock market valuation requires in 2022 and 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations, signaling low dividend risk.

Lastly, Johnson Control’s Uniform earnings growth is above its peer averages and the company is trading around its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.