The FA Alpha Daily provides you with insights and tools to help you build your business.

Today’s analysis highlights Uniform Accounting-based insights that mainstream media likely misses, as well as important talking points for your client.

We hope you find it useful.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Investors are constantly looking to find early trends that will lead to long-term profits.

In late 2021, we regularly highlighted a huge trend we see that will begin playing out over the next few years.

The Great Recession, combined with stalling infrastructure investment in America, has led to corporate assets that are historically old on both a national and corporate level.

To maximize the value companies are getting from their investments into capex, they need to ensure their aging infrastructure is overhauled.

As the economy becomes increasingly data driven, companies will need to ensure that they are poised to succeed by investing in smart investments, from smart buildings to smart machines. This trend is called by experts the Internet of Things (IoT).

Smart investment isn’t just an intelligent reinvestment in existing systems. It entails connecting tools and services to the internet that have never been online before.

However, this connectivity needs to be consistent at all times, during challenging weather environments or heavy network loads as connectivity becomes more essential to operating anything.

This is why stored energy solution suppliers will become a big winner in the growth of the internet of things. Without batteries and power management tools, companies have no way to ensure the continuity of their systems during inclement weather and other uncertain conditions.

One example of these stored energy suppliers is EnerSys (ENS), which manufactures and distributes power batteries, specialty batteries, battery chargers, and power equipment. These are the exact kind of power management tools needed to keep the lights on at all times in the internet of things.

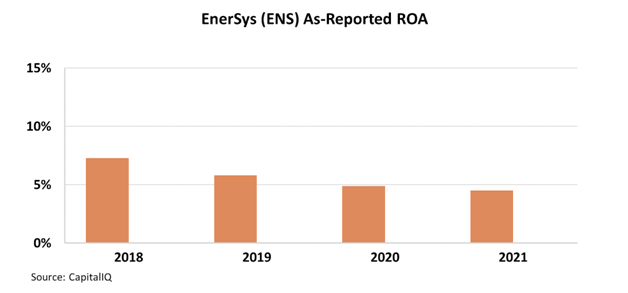

However, looking at the as-reported metrics, it would appear that an investment in EnerSys wouldn’t be like catching lightning in a bottle. Over the past four years, returns have slid from 10% to 7%.

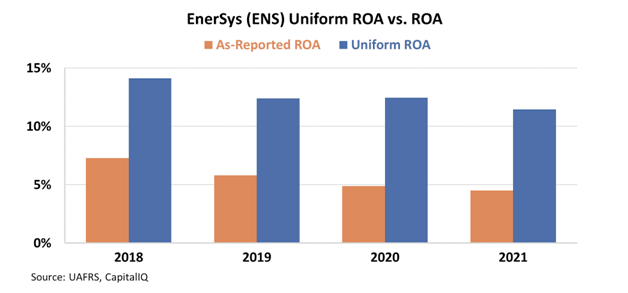

However, a closer look at the business’s real performance tells a much different story. Using Uniform Accounting adjusts for distortions such as goodwill and excess cash which are artificially inflating the assets on the balance sheet

After resolving these discrepancies, we can see that returns have a very different reality. They have not only been well above the cost of capital but above-average returns as well at a rate of 12%-14% throughout.

As investments in smart infrastructure continue to ramp up, names like EnerSys have the power to reap massive returns in 2022 and beyond.

In our Conviction Long List, we highlight a plethora of names that are poised to benefit from this macroeconomic trend that the wider investment community hasn’t yet caught onto. If you are interested in reading more, you can click here to subscribe.

SUMMARY and EnerSys Tearsheet

As the Uniform Accounting tearsheet for EnerSys (ENS:USA) highlights, the Uniform P/E trades at 17.4x, which is below the global corporate average of 24.0x and in line with its own historical P/E of 16.7x.

Low P/Es require low EPS growth to sustain them. In the case of EnerSys, the company has recently shown a 10% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, EnerSys’ Wall Street analyst-driven forecast is 6% EPS decline in 2022 and a 27% EPS growth in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify EnerSys’ $79 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 4% annually over the next three years. What Wall Street analysts expect for EnerSys’ earnings growth is below what the current stock market valuation requires in 2022, but above this requirement in 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations, and intrinsic credit risk is 180bps above risk-free rate, signaling high dividend risk.

Lastly, EnerSys’ Uniform earnings growth is in line with its peer averages, and the company is also trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.