One way to improve the efficiency of supply chains is by cutting down on just-in-time processes and speeding up production. This could drive increased demand for warehouses, benefiting companies like Prologis, Inc. (PLD) that rents out logistics facilities. In today’s FA Alpha, we will look at PLD through the lens of Uniform Accounting and Embedded Expectations Analysis (EEA) to see what the market thinks of the company.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Everyone that tried buying anything in the last two years has experienced the hard truth: our supply chains are old and slow.

As we discussed with Canadian Pacific (CP) last week, ignoring investments in this area led to extended lead times. Neither consumers nor manufacturers are happy about it.

Now, the U.S. is addressing problems and allocating more capital to them. That leads to the trend that we call the “Supply Chain Supercycle”.

As a part of this supercycle, one of the bigger things we are doing is focusing on the idea of nearshoring.

However, that is not the only strategy that is being implemented to make supply chains more efficient. We need them to be more robust, which means less just-in-time manufacturing.

Manufacturers are starting to ramp up production without waiting for orders from the customers to be able to supply the demand in time.

They need access to more warehouses to achieve this goal, and that means more demand for players like Prologis. The company leases logistics facilities to a diverse base of customers in B2B and online fulfillment categories.

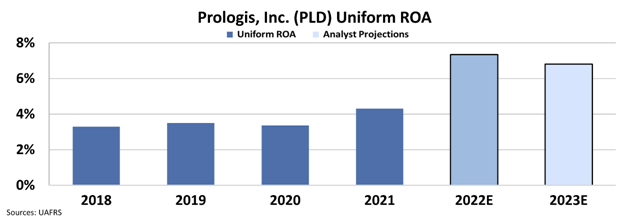

Looking at the numbers using Uniform Accounting, we can see that it’s already starting to gear up for booming demand. While its Uniform return on assets (“ROA”) was only 4% in 2021, analysts expect it to nearly double in 2022, and they expect returns to stay high.

However, just because returns are set to improve, that does not mean the stock is interesting. First, we need to understand what the market thinks.

A business might be thriving with new trends and recent developments. However, if the market is already pricing this news in, it would not make sense to have an investment position.

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

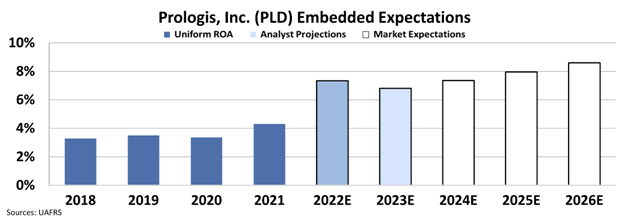

At around $100 price levels, the market expects Prologis’ Uniform ROA to keep expanding. While analysts forecast Uniform ROA to reach 7% in the next two years, the market is already pricing ROA to reach 9%.

Just because Prologis has tailwinds, thanks to the Supply Chain Supercycle, that doesn’t automatically make it a good investment. Understanding valuations, and how the market views the company, are important to consider too.

Even though the near future seems better for Prologis, it might have a hard time satisfying market expectations.

SUMMARY and Prologis, Inc. Tearsheet

As the Uniform Accounting tearsheet for Prologis, Inc. (PLD:USA) highlights, the Uniform P/E trades at 28.1x, which is above the global corporate average of 18.9x, but below its own historical P/E of 44.7x.

High P/Es require high EPS growth to sustain them. In the case of Prologis, Inc., the company has recently shown a 52% increase in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Prologis, Inc’s Wall Street analyst-driven forecast is a 103% growth and -4% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Prologis, Inc’s $100 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 19% annually over the next three years. What Wall Street analysts expect for Prologis, Inc’s earnings growth is above what the current stock market valuation requires in 2022 but below its requirement in 2023.

Furthermore, the company’s earning power in 2021 is below the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 100bps above the risk-free rate.

All in all, this signals average dividend risk.

Lastly, Prologis, Inc’s Uniform earnings growth is above its peer averages, but below its peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.