Sometimes geopolitical risk creates opportunity as with the case in China and Taiwan. Fear of invasion and intervention makes Himax Technologies cheap. This Taiwan-based fabricator business, which provides display imaging processing technologies, is the second-largest sales contributor to China in 2021. In today’s FA Alpha, we’ll see the actual fundamentals of the company using Uniform Accounting.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Wars, trade conflicts, and other types of geopolitical events might negatively affect many companies. As the risk associated with the business increases, the market trades that company’s stock cheaper.

However, sometimes geopolitical risk creates opportunity. If the market overreacts to these risks, then it might be possible to find some names that are mispriced.

We see such an opportunity right now. There is a company printing money, but the fear makes it too cheap.

That company is Himax Technologies (HIMX), a fabricator business in Taiwan that provides display imaging processing technologies.

They recognized $1.3 billion in revenue coming from its biggest end market China in 2021. Its second-largest sales contributor market was Taiwan, with $219 million in revenue.

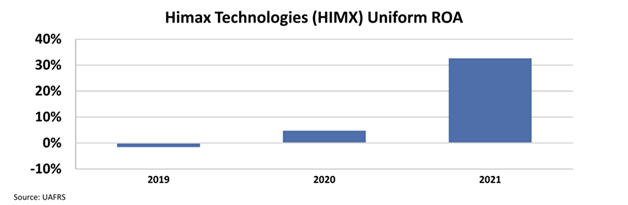

The business has managed to increase its profitability incredibly in 2021. The Uniform return on assets (“ROA”) surged from just above -2% in 2019 to a whopping 33% last year. Also, it had a Uniform asset growth of 36% while having this profitability level.

However, it seems that the market cares more about geopolitical risk than the actual fundamentals of the business.

Currently, the stock is trading at 7x Uniform Price to Earnings (“P/E”) and 1.2x Uniform Price to Book (“P/B”). Both of them are way below the levels seen between 2013 and 2017, when the company was less profitable.

The market fears the actions of the Chinese Communist Party and a possible invasion of Taiwan.

In fact, all of the company’s assets are in Taiwan, not in China. Unlike Foxconn (TWSE:2354), there is no political risk from China but rather a theoretical risk of invasion.

This causes the stock to trade very cheaply, but if the invasion doesn’t happen, there might be a huge upside opportunity.

The impressively high ROA, high asset growth, and low valuation mean that Himax Technologies is a great candidate to be an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

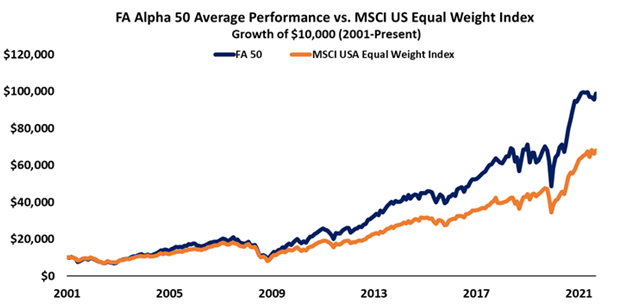

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Himax Technologies (HIMX) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.