Government and stocks are inextricably linked. Almost nothing makes that more obvious than when midterms are on the horizon. Of course, political junkies and voters are paying attention to some of the tight elections nationwide, but investors are also paying close attention. You see, who controls the Senate and the House of Representatives can impact stock performance.

Especially as it relates to taxes and inflation. Tax and inflation rates have a major impact on stock valuations in the long-term.

In today’s FA Alpha Daily, we’ll take a look at how the midterms could impact future valuations.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Investors are on the edge of their seats this election cycle…

And it’s not for purely political reasons.

Right now, both the Senate and the House of Representatives are controlled by the Democratic party. Neither majority is safe, though. Both majorities are up for grabs next month. Smart investors are wondering how the outcome might change market performance over the next two years.

There are right and wrong ways to invest based on elections. Because sentiment changes constantly, it’s important to keep an eye on election data.

Statistical analysis website FiveThirtyEight currently gives Democrats a 55% chance of retaining control of the Senate. And it predicts Republicans have an 80% chance of capturing the House of Representatives.

A divided government might stunt political progress, but it’s great for investors. That’s because Congress won’t be able to change much in terms of policy… specifically, tax policy.

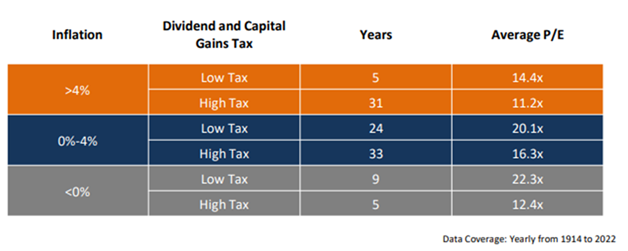

There are two key variables to consider when you think about market valuations. The first is inflation, which we talked about two weeks ago. The other is taxes.

Taxes directly affect how much money from your investments actually makes it into your pocket. So any change to the tax rate will also change how investors value the market.

Higher taxes lead to lower gains. Investors have historically had a more pessimistic view of the market when taxes are high.

We can see this through the S&P 500’s price-to-earnings (P/E) ratio. It tells us the relationship between a company’s stock price and its earnings per share (“EPS”). It’s a way of determining how much extra an investor is willing to spend on a stock compared to earnings.

P/E multiples tend to rise in times of market optimism because investors are confident that valuations will keep climbing. But when market sentiment sours – like when taxes increase – P/E multiples usually fall.

Take a look…

Right now, taxes are relatively low. The current combined dividend and capital gains tax levels are some of the lowest in history. Plus, inflation rates are expected to fall below 3% in the next five to 10 years. We still expect P/E multiples to average around 20 times in this environment.

These valuations could fall if inflation continues to creep higher. The same could happen if taxes jump.

A Democrat-controlled government with sizable majorities (which we don’t currently have) might mean higher taxes.

But if the election results in a split government, that probably won’t happen. Republicans will likely argue for lower taxes while Democrats fight to raise them. In the end, taxes will go nowhere.

As long as taxes stay where they are and the Fed can calm inflation, market valuations should stay high.

Keep a close eye on the election results. They can tell you a lot about what’s to come for the market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.