With its integration, Unity (U) and ironSource (IS) show interesting potential with their partnership. To analyze if they will become a strong company together, our Uniform Accounting will help us to see if integrating with a mobile advertising company can bring more revenue to this mobile game company.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

After much back-and-forth, the biggest deal in mobile app development and gaming is finally settled.

App development platform Unity had its choice between partnering with two ad companies. Back in July, Unity announced it was merging with IronSource to build out its app monetization. By owning the entire revenue stream for mobile apps, Unity is hoping to improve returns to match.

The transaction is a good-sized $4.4 billion purchase all in stock, but it also had the option to be acquired.

Meanwhile, AppLovin approached Unity in August to be bought for nearly $20 billion. The two companies do basically the same thing, though AppLovin is much larger with a greater share of the global market. However, at the end of the day, Unity decided to proceed with Ironsource.

It might seem like that’s the tougher choice: Unity ends up having to integrate Ironsource, and it’s smaller. Applovin would’ve been the easier way out, but not the better way out.

This is because Ironsource is a great company, which is why it’s included in the FA Alpha 50.

However, we can’t see the strength of Ironsource if we didn’t look at the real numbers.

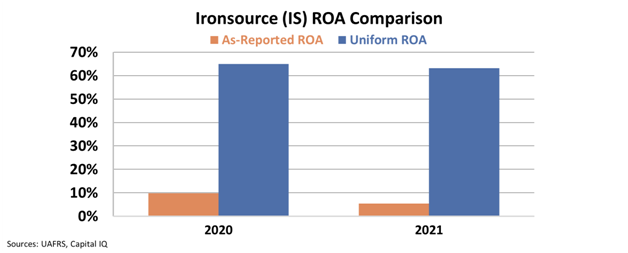

Using GAAP metrics, it would appear Ironsource is a below average performer, with returns at just 5% in 2021. Furthermore, it would appear that returns have halved from 2020 when they were at 10%.

This appearance is just the distorting nature of GAAP accounting. Uniform metrics reflect the true profitability of Ironsource. The company has actually been producing massive returns, with an impressive 63% Uniform ROA in 2021.

The company’s strong profitability and robust growth of 38% in 2021 show that Unity was able to dig through the noise to buy the stronger company.

Furthermore, Ironsource was only trading at an 11x Uniform P/E when it agreed to a merger with Unity, showing that the company is going to be able to create an accretive acquisition for such a low price.

The booming demand, high growth potential, impressive returns, and a low Uniform P/E meant that Ironsource rose to the top to become an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

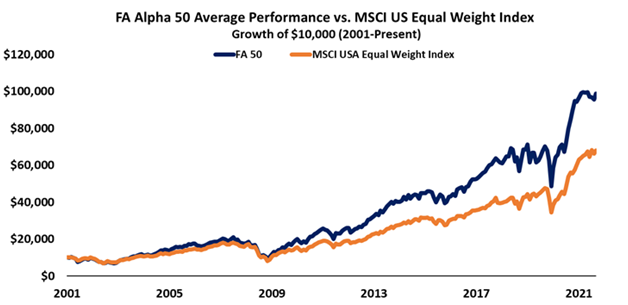

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, ironSource (IS) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.