R&D in the form of improving data and analytics keeps the U.S. at the center of global innovation. Thus, American R&D-heavy companies like Iqvia Holdings (IQV), which specialize in data and analytics for biotech and pharma names, are presumed to have impressive returns. However, the company’s as-reported metrics make it appear that its returns are dismal. Using Uniform Accounting, today’s FA Alpha Daily will dig into its real profitability.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Right now, the U.S. is the center of VC and innovation in the world.

The American Dream has always been centered on the idea of innovation. Following dreams, being ambitious, and creating the life you want.

So, when we translate this American dream to innovation in our economy, the connection is clear.

It’s not just the size of our economy that makes us so dominant in tech innovation, it’s also our commitment to R&D. Unlike some of the other largest economies, we have a decades-long tradition of prioritizing R&D and startups, even if they aren’t the most profitable at first.

This has pushed us to constantly create, which in turn has transformed the U.S. into an innovation dynamo.

One of the key things that has enabled this is data and analytics.

When added to existing frameworks, the combination of these two facilitates innovation. R&D in the form of improving data and analytics keeps our spot in the innovation world secure.

A place where innovation shines brightest is in the world of healthcare. Innovation is the backbone of new cures, formulating vaccines, and developing healthcare.

One of the biggest companies enabling that is IQVIA Holdings (IQV). It provides data, analytics and clinical research management. This allows biotech, pharma, and other healthcare companies to innovate.

It’s also partnered with companies like Salesforce (CRM). The duo is specifically targeting the Life Sciences and Medical Devices industries. It’s optimizing industry data, deep industry experience, and platform technology through the collaboration.

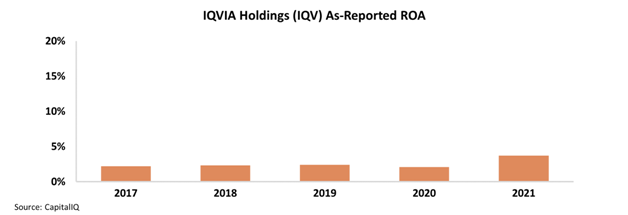

But as-reported makes it look like IQVIA Holdings is not a profitable business.

Although it provides key components of innovation to companies, its as-reported return on assets (ROA) hover at a dismal 2%.

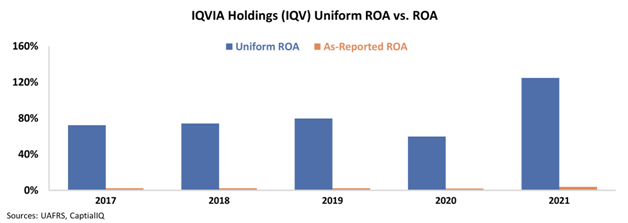

Uniform Accounting, however, shows a completely different picture.

IQVIA Holdings’ ROA is being pulled down by distortions in as-reported accounting. Due to GAAP’s treatment of certain accounting principles in IQVIA Holdings’ financials, among other distortions, the market has been misled about the success of this firm.

IQVIA Holdings’ Uniform ROA is actually impressively strong and increasing. Despite 2020’s dip due to the pandemic, Uniform ROA has increased from 72% in 2017 to a whopping 125% in 2021.

The increase from 2020 to 2021 in terms of IQVIA Holdings’ ROA also demonstrates how imperative they are to innovation in the healthcare space.

The COVID-19 pandemic exposed the need for progress in the medical industry. IQVIA Holdings was perfectly positioned to streamline this innovation. Their Uniform ROA more than tripling speaks volumes to their instrumental role in the pharma and biotech worlds.

With strong Uniform returns and a great position in their space, IQVIA Holdings is a great name the market could be overlooking.

SUMMARY and IQVIA Holdings Tearsheet

As the Uniform Accounting tearsheet for IQVIA Holdings (IQV:USA) highlights, the Uniform P/E trades at 21.7x, which is above the global corporate average of 19.3x, but below its own historical P/E of 23.9x.

High P/Es require high EPS growth to sustain them. In the case of IQVIA Holdings, the company has recently shown a 73% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, IQVIA Holdings’ Wall Street analyst-driven forecast is a 14% and 12% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify IQVIA Holdings’ $239 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 6% annually over the next three years. What Wall Street analysts expect for IQVIA Holdings’ earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 21x the long-run corporate average. However, cash flows and cash on hand are 2x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 110bps above the risk-free rate.

All in all, this signals moderate credit risk.

Lastly, IQVIA Holdings’ Uniform earnings growth is above its peer averages, but the company is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.