While those without pools think they want one during the summer, pool owners may disagree due to cleaning struggles and maintenance costs. Today’s FA Alpha Daily will dive into the profitability of pool equipment provider, Hayward Holdings, Inc. (HAYW).

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

My father’s last 3 homes all had pools. Every time he moved, he swore he’d never buy another house with a pool.

They don’t get used often enough, they’re a hassle to keep clean, and they’re just not worth it. And yet, once he’s in the market, he always ends up with another pool.

The number of people who find themselves in that perpetual loop has grown in the past three years with the At Home Revolution. Many people have built homes, bought homes, or renovated homes that have pools in them.

While the rush to build more homes may be slowing with mortgage rates surging, all that new installed base means one thing: more people are in the same situation as my father, with pool regret.

Pools are expensive to maintain, and there’s no way you aren’t going to maintain them and let them become a mosquito breeding ground in your backyard.

This situation benefits companies like Hayward Holdings (HAYW), which make the pool equipment you need to tend to your pool and the company is going to continue to see healthy demand, no matter what happens with new builds.

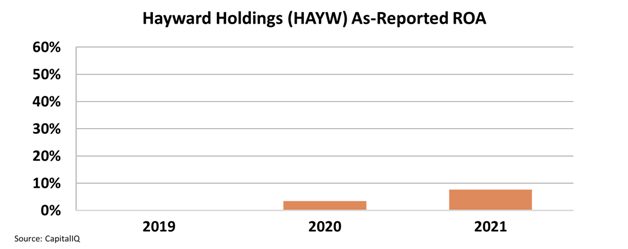

However, as-reported metrics make it look like supplying this boondoggle of home addition isn’t very profitable.Hayward’s return on assets (“ROA”) was just 7% in 2021 and was even lower in the past two years.

Considering, Hayward’s offerings and its competitive positioning, these ROA levels are well-below corporate averages.

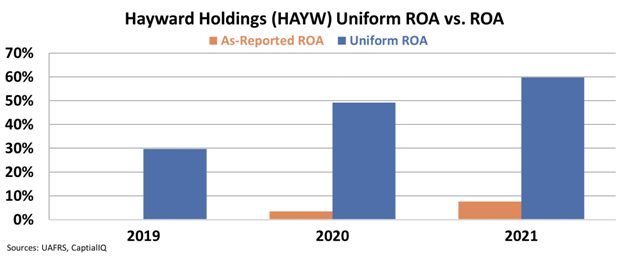

On the other hand, Uniform Accounting clears the noise from the distortions of as-reported metrics and reflects the demand for Hayward’s products and its profitability.

After making more than 130 adjustments to the financial statements of the company, Uniform Accounting reveals that Hayward’s ROA is actually 60%, not 7% in 2021. And in 2020 it’s 50%, not 4%.

While the company boosts profitability with high ROA and high growth, it is also trading at a modest 13x Uniform P/E, saying the market isn’t pricing in that resiliency.

Consistent high growth, high ROA levels, and low valuation make Hayward a compelling FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

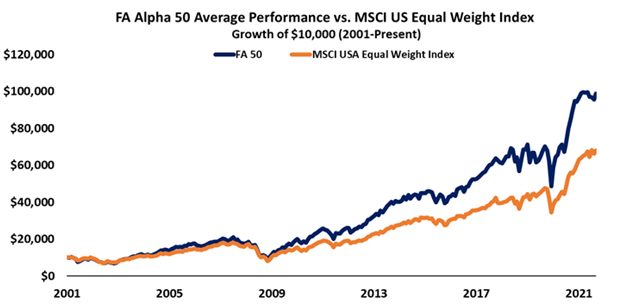

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Hayward Holdings, Inc. (HAYW), is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.