Victoria’s Secret has been known for the past several decades as one of the leading lingerie companies across the globe, but issues of ownership have stained the company’s reputation in recent years. Despite this, the company continues to be resilient and maintain its reputation as a top-tier lingerie brand, but credit rating agencies do not seem to recognize the whole picture of its recovery. Today’s FA Alpha will look into the true profitability of this global brand and determine what are the company’s true risks.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Victoria’s Secret is one of the biggest “intimate apparel” companies in the country, if not the world. It sells fairly affordable products and has some of the best marketing in the business.

It had a rotating list of models known as “angels,” and the company’s fashion show is one of the biggest of the year. At one point, you can probably find Victoria Secret stores in nearly every mall across America.

However, the company’s heyday was during the tenure of Les Wexner’s L Brands.

L Brands bought VS in 1982 and helped bring it into the limelight, along with several other household brands. It also helped bring Abercrombie and Fitch to scale and build brands like Express and The Limited.

L Brands dominated malls across America, and Victoria’s Secret was one of its best businesses. However, all of that started to change in the last few years.

Even before the pandemic, mall traffic started slowing down. There was more online competition, and L Brands’ mall presence wasn’t nearly as valuable.

To keep itself afloat, selling off brands became a must. By the time the pandemic hit, L Brands only had two businesses: Victoria’s Secret and Bath & Body Works.

The pandemic completely shut down malls, and many investors got worried that L Brands wouldn’t make it through. In a last-ditch effort, it finally spun off Victoria’s Secret, leaving only Bath & Body Works.

Victoria’s Secret looked like it was cast aside in the process, and the market views it like it was unloved and unwanted.

Credit markets view the company with a bankruptcy risk, partly because of its former owner’s rocky history.

Today, credit rating agencies like S&P misunderstand the company, and they think that there is a 10% chance that Victoria’s Secret will go bankrupt, rating the company BB-.

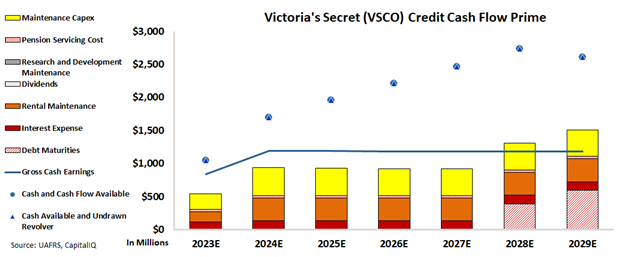

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Victoria’s Secret cash on hand covers all obligations and its cash flows consistently exceed operating obligations for the next six years.

Looking at the CCFP, we can see that Victoria’s Secret likely has nothing to worry about. It has a clean bill of health, and it’s still one of the biggest lingerie brands in the country.

As a result, Victoria’s Secret gets an IG3+ rating from Valens. This corresponds to a default risk of less than 2%, which makes much more sense considering the company’s cash flows and liabilities.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Victoria’s Secret & Co. Tearsheet

As the Uniform Accounting tearsheet for Victoria’s Secret & Co. (VSCO:USA) highlights, the Uniform P/E trades at 13.9x, which is below the global corporate average of 19.3x, but above its historical P/E of 6.2x.

Low P/Es require low EPS growth to sustain them. In the case of Victoria’s Secret, the company has recently shown a 125% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Victoria’s Secret’s Wall Street analyst-driven forecast is for a -32% and 8% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Victoria’s Secret’s $34 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 is 2x the long-run corporate average. However, cash flows and cash on hand are more than 2x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 120bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Victoria’s Secret’s Uniform earnings growth is in line with its peer averages and is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Victoria’s Secret & Co. (VSCO) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.