With the dramatic rise in oil prices and decrease in US reserves, drilling companies like California Resources Corporation (CRC) are well-positioned to reap the benefits. Today’s FA Alpha Daily will analyze the company’s real credit risk looking beyond its B+ rating.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

California Resources Corporation (CRC) is an oil and natural gas company that specializes in oil exploration.

For the past eight years, it’s been in the doldrums.

Following the shale boom of 2014 when OPEC tanked the price of oil, there was no need for U.S. producers to find new sources of oil. Exploration names like California Resources were in dire straits.

However, now that oil is hitting high prices and reserves across the U.S. are drying up, drilling companies are once again knocking on California Resources’ door in search of more oil in regions like the Permian Basin.

Given California Resources’ carbon capture initiatives, it has become one of the most dynamic names in the space.

However, the credit rating agencies seem to have completely missed this. They’ve rated the company a highly speculative B+ rating, implying a nearly 25% chance of bankruptcy within the next five years.

This makes no sense looking at the huge tailwinds California Resources is seeing, especially since the name is already boasting strong cash flows.

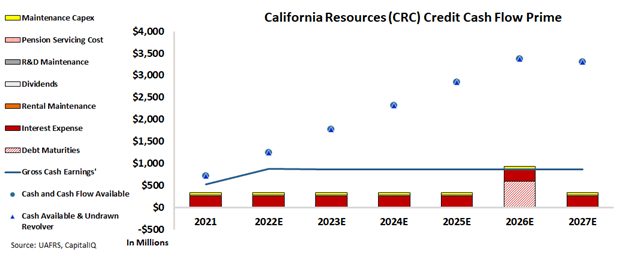

We can figure out the true risk by examining it through the lens of Credit Cash Flow Prime (“CCFP”).

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Currently, cash flows exceed all obligations through 2026 and are growing over time. It also has no debt maturities on its balance sheet for the next few years.

Given its significant cash buffer, we are left with a company that is facing a very low risk of bankruptcy.

That’s why the name deserves the much safer investment-grade IG3- rating, which implies just a 1% chance of bankruptcy, and much better reflects reality.

California Resources Corporation is yet another company where the credit rating agencies don’t capture the complete story. While we at Valens recognize the flaws with traditional credit ratings, many creditors do not. The B+ credit rating is pessimistic and paints a picture of a company that is much riskier than it is in reality.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and California Resources Corporation Tearsheet

As the Uniform Accounting tearsheet for California Resources Corporation (CRC:USA) highlights, the Uniform P/E trades at 8.6x, which is below the global corporate average of 24.0x, but above its historical P/E of -63.4x.

Low P/Es require low EPS growth to sustain them. That said, in the case of California Resources, the company has recently shown a 2% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, California Resources’s Wall Street analyst-driven forecast is for a 118% EPS shrinkage and a 240% growth in 2021 and 2022, respectively.

Furthermore, the company’s earning power in 2020 is below the long-run corporate average. However, cash flows and cash on hand are almost 3x its total obligations—including debt maturities and capex maintenance. All in all, this signals a low dividend risk.

Lastly, California Resources’s Uniform earnings growth is below its peer averages, and the company is also trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of California Resources Corporation (CRC) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.