The season of third-quarter earnings is essentially over. Most businesses have now released their quarterly results. In the most recent reporting cycle, only 69% of companies outperformed earnings estimates. It’s a concern for the overall market economy. In today’s FA Alpha, we’ll look at some of the top and bottom performers in the third quarter and assess what that means for the years ahead.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Investors are setting their sights on a strong close to the year…

We’re basically through the third-quarter earnings season. Most companies have released quarterly results. And we have a clear picture of their performance.

This is a good opportunity to check on how corporations are doing. For most companies, the fourth quarter ends on December 31. So, we can get a sense of what to expect from full-year earnings results.

It looks like we’re in the midst of what’s called an “earnings recession.” That happens when trailing 12-month (“TTM”) earnings decline for two or more consecutive quarters.

TTM earnings fell in the second quarter compared to the first. And with 98% of companies reporting third quarter earnings, it looks like they’ve dropped again.

As-reported earnings for the S&P 500 have weakened from $198 billion TTM in the first quarter down to $187 billion TTM in the third quarter.

Even so, the most worrying thing isn’t that earnings are down. We’ve known this would be the case for almost half a year.

What’s truly worrying is that earnings trends are deteriorating…

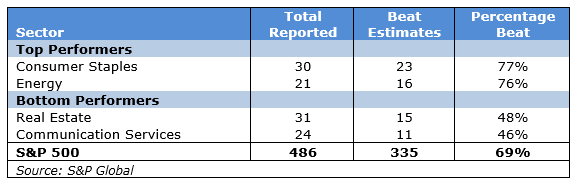

Over the past 10 years, an average of 72% of companies beat earnings estimates. This number improved since the pandemic began. Since the second quarter of 2020, the beat rate jumped to a staggering 81%.

That’s no longer the case. Only 69% of companies beat earnings estimates in the most recent reporting cycle. It’s a worrying sign for the market as a whole… And it furthers our concern that we’re likely to get a “real” recession in 2023.

Still, that doesn’t mean everything is bad. The market doesn’t move in unison. Individual sectors can enjoy huge tailwinds or fight massive headwinds. These can pull the overall market in one direction or another.

And where one sector struggles, another might find success.

This can be easy to ignore when the overall market is improving. That’s not the case today. We’re facing a downturn… So it’s important to look deeper at individual sector trends.

We can see this by examining quarterly earnings beats and misses on a sector level.

It’s not enough to just look at a sector’s surface-level performance to see if earnings went up or down.

You also need to consider whether earnings are getting weaker or stronger than analysts expect. At the end of the day, outperforming expectations helps propel a company’s stock price.

Five sectors performed above average in the third quarter…

The top area was consumer staples, followed by energy… which has some sound tailwinds. Energy has been able to deal with inflation, and strong demand should benefit the sector in the near term.

However, these same tailwinds could actually hurt consumer staples going forward.

If inflation continues to rise and we enter a real recession, people will tighten their purse strings even more. Consumer-staples companies will find it hard to raise prices.

On the opposite end of the spectrum, there were some notable underperformers. Communication services – a market darling for the past 10 years – was the worst-performing sector of the third quarter.

Less than half of companies in this sector beat estimates. Companies like Google parent Alphabet (GOOGL) and Facebook owner Meta Platforms (META) have been feeling the pressure of a contracting economy.

Real estate has also been crushed thanks to rising interest rates. Its beat rate was marginally better than communication services, at 48%.

The data shows us that consumer staples and energy are trending upward. That gives us a great starting point to identify promising stocks. (Remember, 50% of stock performance is based on the underlying sector.)

It also tells us what areas of the market to avoid. Communication services and real estate have disappointed investors lately. It’s a good idea to stay away from these sectors until the trend reverses.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.