Extreme weather conditions that frequently happen in the U.S. destroy aging infrastructures. This gives an opportunity to companies like Cummins (CMI) as the country needs more generators and truck engines to do renovations and replacements. However, as-reported metrics fail to recognize this potential. In today’s FA Alpha, we will discover how the Uniform Accounting shows Cummins’ true underlying potential.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Puerto Rico just got hit by a deadly hurricane that wiped out power and much of its infrastructure.

Unfortunately, climate change is already happening, and we may see more of these extreme weather conditions in the near future.

Extreme weather patterns are becoming more common, especially in the U.S. We all remember the recent winter storm in Texas, tornados in the Midwest, and the historic rainfall that the atmospheric river brought to California after a decade of drought.

These are just a few examples of how much extreme weather is destroying aging infrastructure in the country.

Infrastructure needs to be more resilient by renovations and replacements. We call this the “Supply Chain Super Cycle.” After a historic period of underinvestment into capex, the U.S. is entering a new period of infrastructure spending that will ripple out across the economy, fueling growth.

There are already big gains from generator manufacturers like Generac Holdings (GNRC) and Cummins (CMI) who are benefitting.

Cummins produces large standby generators, but it is known the most for its truck engines.

With struggling supply chains and infrastructure, we need more trucks to transport more things. Also, we need them to be resilient.

This creates a huge tailwind for Cummins, and it is in a great position to benefit from the Supply Chain Super Cycle.

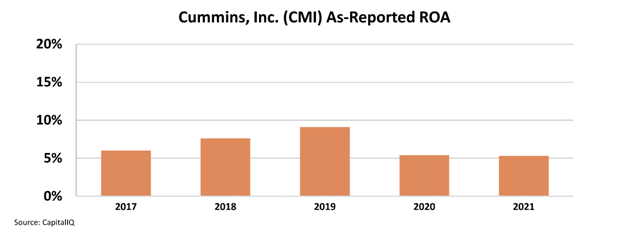

However, investors looking at the as-reported metrics are not convinced. It seems like Cummins couldn’t really benefit from these tailwinds and recover from the 2020 dip.

The as-reported return on assets (“ROA”) of the company dropped from 8% in 2019 to 6% in 2020 as a result of the pandemic. It remained at 6%, failing to recover.

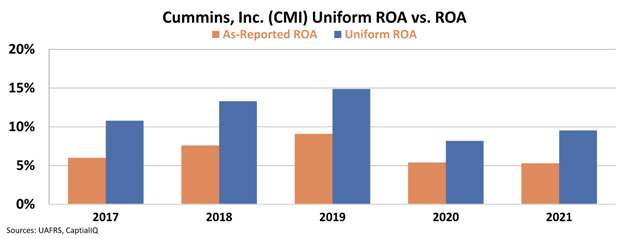

However, this picture of Cummins’ profitability is not accurate. This is because of the distortions in as-reported accounting. We can clear the numbers and see the actual performance of the company by doing the 130 adjustments needed under Uniform Accounting.

Uniform Accounting shows that the company was actually twice as profitable as the as-reported metrics suggest in 2019.

The Uniform ROA of Cummins dropped from 15% in 2019 to 8% in 2020. In 2021, big tailwinds pushed the profitability upwards, and the company recognized a Uniform ROA of 10%.

This is only the beginning of the acceleration in profitability.

It is likely to run a lot more thanks to the Supply Chain Super Cycle and the need for more resiliency and redundancies.

Investors only looking at the as-reported metrics would not see this acceleration and think the company could not recover after 2020.

Uniform Accounting shows this is not the case and that the company is just beginning its return to high profitability.

SUMMARY and Cummins, Inc. Tearsheet

As the Uniform Accounting tearsheet for Cummins, Inc. (CMI:USA) highlights, the Uniform P/E trades at 14.6x, which is below the global corporate average of 19.3x and its own historical P/E of 18.6x.

Low P/Es require low EPS growth to sustain them. In the case of Cummins, Inc, the company has recently shown a 24% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Cummins, Inc.’s Wall Street analyst-driven forecast is a 30% and 24% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Cummins, Inc’s $219 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 2% annually over the next three years. What Wall Street analysts expect for Cummins, Inc.’s earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 2x the long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 80bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Cummins, Inc.’s Uniform earnings growth is above its peer averages, but in line with peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.