There are 26 million out of 43 million Americans, with federal student loan debt, who have sought forgiveness and 16 million applicants have been approved. We weren’t worried about the economy in the early stages of the pandemic since consumer balance sheets were solid. However, the impacts of the pandemic had a huge influence on the economy, and student loan payments are soon to resume. In today’s FA Alpha, we will discover if consumer balance sheets are as solid as we believe they are, which might influence a potential recession.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Recent graduates got a small break during the pandemic.

A series of student-loan relief efforts have gone into effect in the past two-plus years. The goal was to make things a bit easier for young adults as the structure of college disappeared.

These changes were never intended to be permanent.

They started in 2020, when then-President Donald Trump paused federal student loan payments. That meant people didn’t need to worry about paying off this debt while also worrying about COVID-19. Even better, interest didn’t accrue on these loans while they were paused.

This year, President Joe Biden tried to take student-debt relief a step further. He released a plan to forgive up to $10,000 in student loans for qualifying borrowers. (The plan is currently on hold as numerous states attempt to block it.)

About 43 million Americans have federal student-loan debt. Nearly 26 million have applied for forgiveness so far. And 16 million applicants have already been approved.

Even though these steps sound like a great thing for recent graduates, the reality is a little less certain.

Since Biden’s program is currently on hold, any related relief is up in the air. And the pause on student-loan payments is set to expire by the end of the year. Payments will likely resume in January.

This will be a test on how strong consumer balance sheets are.

One of the reasons we weren’t worried about the economy early in the pandemic was because consumer balance sheets were strong. Folks were saving more money and student debt payments were on pause.

All in all, most people were able to pay their debts. That’s always a good sign.

We’re about to face a reckoning. One of the last pandemic-era consumer relief programs is about to end… and we need to pay attention. It’s possible delinquency rates for student loans will rise if payments resume next year.

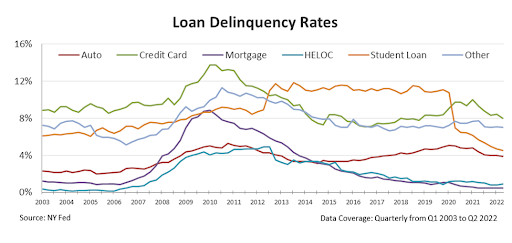

Delinquency rates refer to the percentage of loans with late payments. The New York Federal Reserve tracks these for student loans as well as other types of debt.

Historically, student loans have had some of the highest delinquency rates for any type of debt. They were higher than auto, credit card, mortgage, home equity line of credit, and other consumer loans between 2013 and 2020.

That changed with the pandemic relief measures. Since 2020, delinquency rates on student loans have been remarkably healthy.

Only 5% of student loans have been delinquent so far this year, compared to 11% in 2019. Of course, that’s being helped by the pause on payments.

If student-loan payments resume in 2023, the number of delinquencies may return to the levels we saw for most of the past decade.

With current high inflation, that delinquency rate might be even higher than we’re used to.

To make matters worse, a rise in student-loan delinquency could cause a domino effect. If people are under pressure to pay off student debt, they might put other debt on the back burner.

These past two years have been kind to people with student debt. And that looks to be ending. We’re now entering a much more challenging economic environment.

A major recession indicator recently flashed a warning signal, and the Fed is raising interest rates to slow down inflation.

It seems to be working.

The consumer price index, which tracks inflation, came in at 7.7% for October. While this number is still high, it’s the lowest rate since January. And it’s much lower than the 9.1% level we saw in June.

As the Fed continues to battle inflation, our economy could fall into a recession sometime in 2023. If student loan rates increase and bring other delinquency rates up with them, the recession could be scarier than we expect.

We don’t think that’s likely right now, but we won’t know for sure until January.

As it stands, student-loan debt is the first real test to determine how bad a potential recession will be. Keep a close eye on these developments in the coming months.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.