While tech shares have recently seen a downturn, firms supporting the “Internet of Things” (IoT) appear to be performing relatively well. Today’s FA Alpha Daily will analyze if MaxLinear, Inc. (MXL), a manufacturer of semiconductors and several other connectivity products, has capitalized on the tailwinds of the IoT revolution.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Everyone has soured on tech in recent months.

Several of the big names, like Meta (FB), Amazon (AMZN), Snapchat (SNAP), and Netflix (NFLX), have all recently nosedived. Exceptionally strong growth during the pandemic wasn’t sustainable for these firms, and now that’s slowing down.

This means lower valuations and more negative sentiment around these companies, with investors worried about how these dominant firms will continue to expand.

But if you look away from the software-as-a-service (“SaaS”) and subscription-based models that seem to all be losing subscribers, there are some tech companies that are still doing well.

The Internet of Things (“IoT”) is changing how we integrate technology in our everyday lives, and the firms that help with connectivity are becoming more essential. While many big tech names struggled in the past few months with growth, the IoT market grew by 22% through 2021.

The IoT combined with companies entering a capex super cycle and starting to invest means firms like MaxLinear (MXL) are well-positioned going forward, even as other tech firms seem to struggle.

MaxLinear (MXL) offers semiconductors and supporting products, such as WiFi routers and DSL broadband modems, to offer complete integrated networks.

Its Connectivity business line provides whole-home internet connectivity. With more people permanently working from home and the IoT pushing for more things to become integrated technologically, it has seen an uptick in demand.

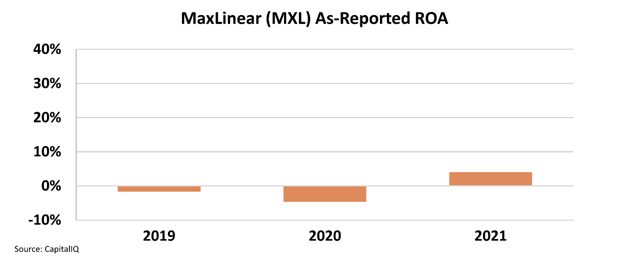

But as-reported metrics make it appear that MaxLinear has only seen positive ROA in just one of the past three years. Its return on assets (“ROA”) inflected positively from negative levels in 2019-2020 to below-cost-of-capital levels of 4% in 2021.

For a firm at the core of the IoT movement, these returns are disappointing.

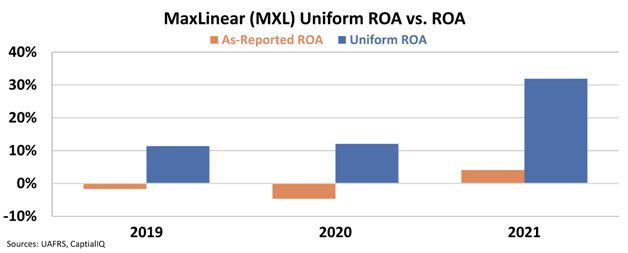

However, Uniform metrics show us a different picture. MaxLinear has actually been positive all those years, with returns far exceeding those that as-reported metrics show.

MaxLinear had 11%-12% ROA levels even before there was a push for greater connectivity. In 2021, when demand soared, its ROA jumped to 32%.

At the same time, it saw explosive growth, jumping to 44% in 2021. It’s using its improving profitability to continue growing by investing in new technology and capabilities.

Yet the market is missing all the IoT tailwinds MaxLinear is taking advantage of, as it’s pricing the firm at a bargain 11.9x Uniform P/E.

This low valuation, combined with strong asset growth and ROA, is what makes this a compelling company and an interesting FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

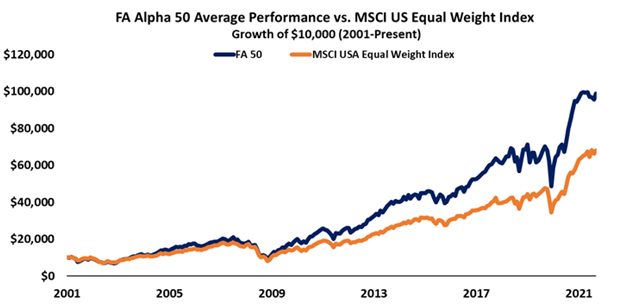

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, MaxLinear, Inc. (MXL), is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.