R&D-focused companies are seeing lower valuations due to the cynical outlook on mRNA technology. Maravai LifeSciences (MRVI) is one of the key players in providing essential supplies such as nucleic acids and testing equipment for proteins to support research on human diseases. Today’s FA Alpha will exhibit the vital elements in supporting mRNA innovations regardless of when the market is pricing these technologies to vanish.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The United States has been the center of innovation for many industries, and these innovation pioneers have recognized incredible returns.

Last week, we talked about Moderna (MRNA) and how it unlocked innovation with the new mRNA vaccines. However, it didn’t achieve that on its own.

For research and development (R&D), companies need a lot of equipment that only a select group of companies can provide.

Many would think of the equipment that players like Illumina (ILMN) or Thermo Fisher Scientific (TMO) offer. These tools include laboratory products, specialty diagnostics tools, analytical instruments, and many more.

However, there is another very essential supply that companies focusing on R&D need. These are essential reagents and biochemical products. Nucleic acids and testing equipment for proteins are only two examples of many offerings in this area.

One key player specializing in this space is Maravai LifeSciences Holdings (MRVI). The company provides products to enable the development of drug therapies, diagnostics, and support research on human diseases.

The nucleic acid production segment, which provides the technology for mRNA vaccines, has grown massively in the last three years. The revenue generated from this segment reached $713 million in 2021, a tenfold increase from $72 million in 2019.

The business is extremely vital for the mRNA innovation that is just taking off. The innovation would not work without its technology.

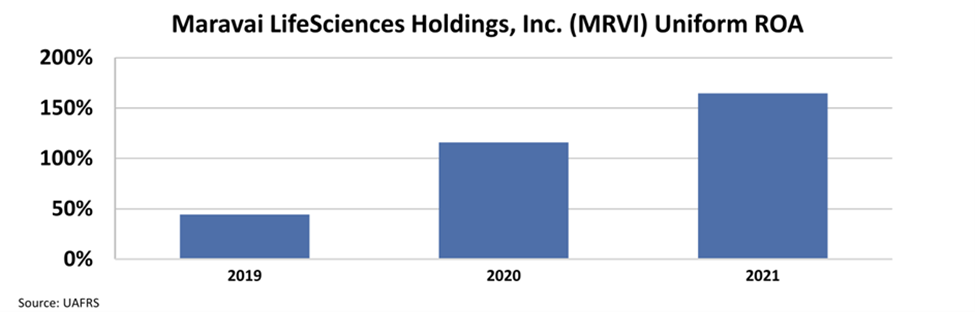

This huge growth is reflected in the company’s profitability as well. The Uniform return on assets (“ROA”) of Maravai nearly quadrupled from 44% in 2019 to 165% in 2021.

The mRNA technology just started to spread, and the investment in this is not going away.

However, the market doesn’t seem to value this as much. Despite the very high ROA and high growth, the market is pricing the company to vanish, resulting in very low valuations.

The company is trading at an extremely low 4.8x Uniform P/E and 8x Uniform P/B. Compared to the 6.1x Uniform P/E and 24.4x Uniform P/B in 2020, the stock has taken a massive hit.

Even if the company could not sustain current levels of profitability going forward, current expectations look too pessimistic.

That is why it showed up on our screen. Its massive profitability, high growth, and low valuations make it an interesting FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

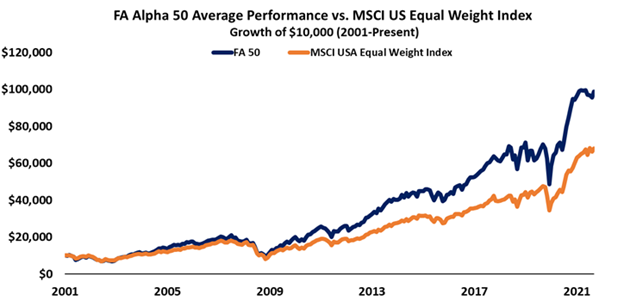

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Maravai LifeSciences Holdings, Inc. (MRVI) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.