Inflation data has been the main force driving markets and the economy with CPI and PCE data receiving most of the spotlight. However, this data only gives us an idea of past and current inflation and fails to look into the future. In today’s FA Alpha, we will look into the University of Michigan’s expectation on inflation, why it matters and where it believes markets are heading.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Between the 10th and the 13th of each month, the U.S. Bureau of Labor Statistics releases the consumer price index (“CPI”) data. It measures the monthly change in prices paid by consumers.

And at the end of the month, the Federal Reserve issues data on its favorite inflation-tracking metric, personal consumption expenditures (“PCE”).

Investors have been glued to the calendar all year. Inflation is the single largest factor pushing the Fed’s interest-rate hikes. As a result, it’s also the main force driving the market and the economy.

If inflation improves, the market will follow suit. So it makes sense that people think tracking CPI and PCE data is their best bet to prepare for future market conditions.

But they’re watching a sideshow. These numbers aren’t what really matters for inflation.

The CPI and PCE only give investors a surface-level indication of inflation.

A few days after the monthly CPI report is released, a non-government research group issues a much more important data point. It tells us what the Fed is really worried about.

We’re talking about the University of Michigan’s inflation expectations survey.

Sure, it’s important to know where inflation is at the moment. That’s what the CPI and PCE results tell us. But these metrics don’t give us insight into how long the current inflation levels will last.

The inflation expectations survey, on the other hand, indicates where consumers expect inflation to go in the future. It gives us inflation estimates for the next year, the next five years, and the next 10 years.

This information is invaluable. If everyone thinks high inflation is “new normal,” workers will ask for wage hikes to offset higher prices. Companies will hike prices more aggressively to offset these higher wages… and higher costs all around. The result of this is more spending and more inflation.

It’s not just inflation by itself that’s a problem. It’s the expectation for high inflation. That’s what creates a dangerous feedback loop.

On the other hand, if consumers think inflation is just a temporary blip, the picture looks brighter. The University of Michigan survey can also tell us if prices are likely to calm down in the near term.

The most recent survey came out on October 14. We’ll start with the bad news…

Consumer inflation expectations for the next year rose from 4.7% to 5.1%. This is the first time that one-year inflation expectations have increased since April.

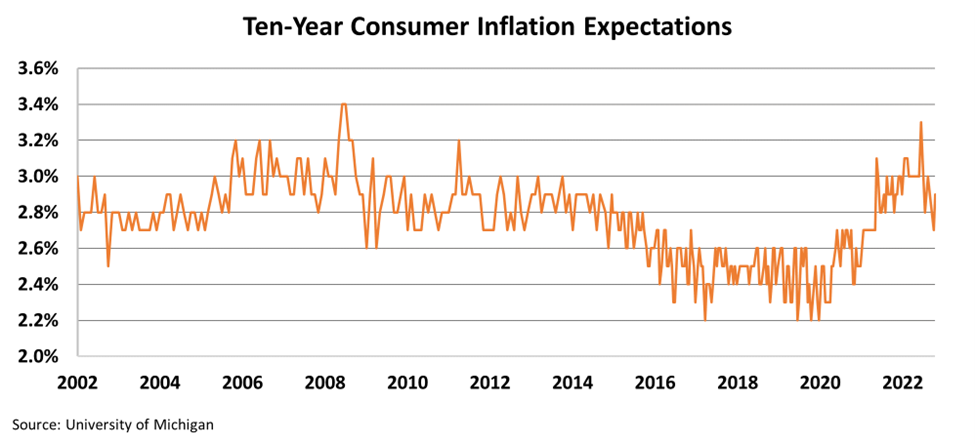

Now for the good news. Consumer expectations for the next 10 years are also up. They rose from 2.7% to 2.9%.

The good news is not that expectations rose… it’s that they’re still totally normal. Expectations are still below 3%. This is in line with where ten-year inflation expectations have been long before inflation became a hot-button topic.

Even over the last 20 years, 2.9% is pretty average.

Consumers understand that inflation won’t magically go away next year. But they don’t expect high inflation to last forever.

This means the Fed might avoid going “full Volcker” with drastic inflation-quelling measures. Significant Fed involvement would likely send the market into a tailspin.

In the near term, it’s important to keep an eye on any changes in consumer expectations. But for now, it looks as if the market will largely be able to solve its own problem.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.