While technology stocks are falling rapidly since growth has become endemic to the market, industrial stocks are booming with the capex supercycle in the U.S. Today’s FA Alpha Daily will cover the trend reversal of these sectors.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

The S&P 500 Index, Nasdaq Composite, and Russell 3000 indices fell more than 10% from all-time highs.

While many are focused solely on the headlines, which shows the entire market falling equally, a closer look highlights that we’re also seeing a shift in investor preferences, with different sectors winning and losing.

This split in the market becomes clear by breaking apart the underlying trends of each market segment. It’s especially true in the technology-dominated Nasdaq, which has fallen more sharply than the other indexes.

In recent months, a massive shift in investor preferences has shaken up the technology sector’s recent dominance over the market.

Technology stocks have consistently been among the most overweight sectors held since the Great Recession. The sector has been underweighted for the first time since December 2008.

Many analysts are chalking this up to higher interest rates disproportionately hitting tech stocks. As tech stocks grow faster than the average company, increasing interest rates mean these names have a harder time securing capital to invest for growth.

But there is a different reason for this shift, and it requires digging a bit deeper.

As we get closer to the coronavirus becoming an endemic. Many think the word “endemic” will be the buzzword for the first half of the year.

While we agree endemic helps describe early 2022, we aren’t using the word as a pun on the pandemic.

More important than the coronavirus reaching its endgame, growth has become endemic to the market. Throughout an economic cycle, traditional growth names like technology stocks promise to compound returns for investors.

Companies across all industries are growing and improving earnings, meaning earnings growth has become endemic to the market. Without that competitive edge in tech, investors are leaving for cheaper growth.

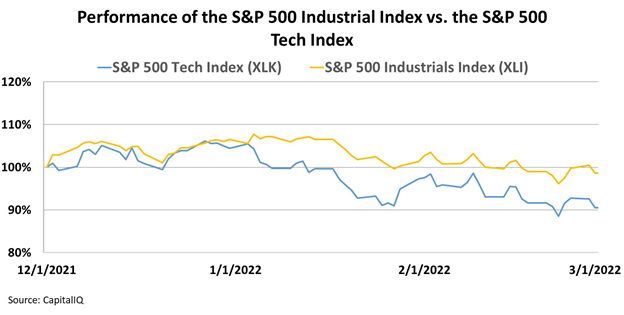

The reason why the S&P 500 Industrials Select Sector Index (XLI) has outperformed the S&P 500 Information Technology (XLK) is that as endemic growth sets in, investors can find growth at more attractive valuation multiples in industrials.

The shift into industrials specifically is being driven by investors starting to sniff out something we’ve been saying to our institutional clients and newsletter subscribers for a while. Not to mention, we’ve been beating the drum here on the Investor Essentials Daily for months as well.

The industrial stocks are being powered by the capex supercycle that is sweeping the U.S. Thanks to historic underinvestment into both corporate and national infrastructure across the nation after the Great Depression, the U.S. is primed for a huge spending wave coming out of the pandemic.

This aging infrastructure is the underlying driver of inflation, as businesses have been unable to produce enough goods to meet ramping demand.

The supercycle is beginning to get underway, and its impacts can be seen in every metric we’ve highlighted recently. From management sentiment to commercial and industrial (C&I) loan growth, the signs point to huge industrial spending.

While not beneficial for high valuation growth names, growth becoming endemic is a boon for relatively cheap industrial stocks. It will make technology names less compelling as competition for growth investors ramps up.

As the theme of 2022 becomes clearer and clearer, it’s vital for investors not to be left behind

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, get access to FA Alpha Pulse.