Since the dot-com bubble, the internet has been a big part of our lives. One would expect GoDaddy (GDDY), a market leader in virtual private server hosting, to have immense profitability. While as-reported metrics make it seem like GoDaddy isn’t making any money at all, today’s FA Alpha Daily will examine the company’s actual performance.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Perhaps the greatest invention of our time, no one connecting UCLA to Stanford back in 1969 could have imagined the impact the internet would have on all of our lives.

As people started to understand how it could change our lives dramatically, almost every technology company raced to take a piece of it.

That is how the dot-com bubble started in the late 90s. The stock market rose 400% in five years, only to fall 78% from its peak in just two years.

Many technology companies filed for bankruptcy, and the remaining ones lost substantial portions of their market capitalizations.

But the internet survived. Two decades later, it is still the greatest technology that enables us to build upon our existing knowledge and connect with the rest of the world.

Along with large businesses, it is a heaven for entrepreneurs and small businesses trying to make their voices heard.

Of course, people need intermediary services to use such a tool to their benefit. If you want to set up a website, you need access to design applications, servers, domain providers, development environments, and many more.

One of these service providers is GoDaddy (GDDY), the go-to company to buy a domain name and have access to promotional tools for your website.

The company specifically aims to support independent entrepreneurial ventures, helping users create content, build their website, manage online marketing, connect to social media, and sell products and services.

GoDaddy also takes care of hosting and provides security for the content and data the user has. It dominates the virtual private server (VPS) hosting with a market share of 23%.

Being the essential gatekeeper for the internet should be highly profitable, and yet as-reported metrics make it look like the best brand in the space is basically making no money.

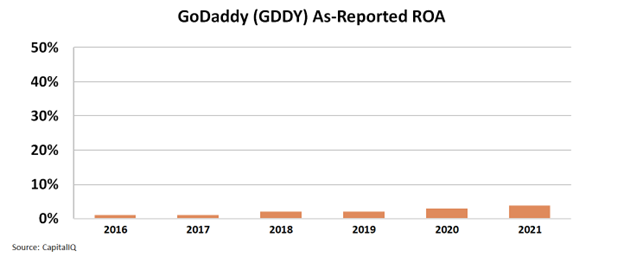

The as-reported return on assets (“ROA”) of the company was below the cost of capital each year after the company went public. The metric sluggishly climbed from 1% in 2016 to only 4% in 2021.

These returns would certainly not make the shareholders happy. Returns below the cost of capital would mean that the risk of holding the stock is just not worth it.

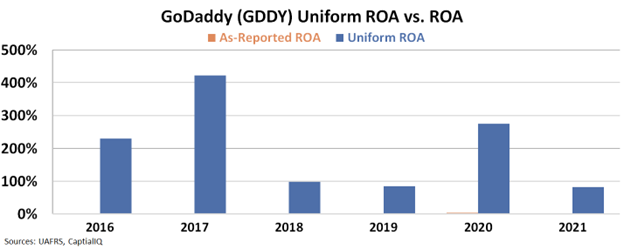

However, this picture of GoDaddy’s performance is not accurate. This is due to distortions in as-reported accounting and can be fixed by making the over 130 adjustments needed under Uniform Accounting.

The reality is that the company is successfully using its dominant, almost monopolistic position in the space and enjoying incredible profitability.

The Uniform ROA of the company was not only above the cost of capital, but it also reached a maximum of 423% in 2017 and stayed at 82% in 2021.

Investors using the as-reported metrics would fail to see the actual profitability of the company and think that the company is not generating any money at all, with below the cost of capital returns.

Uniform Accounting clears the picture and helps investors make an informed investment decision.

High ROA levels, continued investment to keep the market dominance and low valuations make GoDaddy a compelling FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

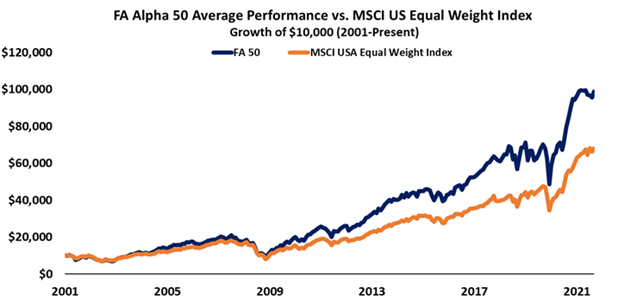

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, GoDaddy (GDDY) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.