As shortages of new vehicles prompt buyers to go for used cars, Copart, Inc. (CPRT), a leading global provider of online auctions and vehicle remarketing services, is ready to drive into the spotlight. Today’s FA Alpha Daily will examine Copart’s profitability from a Uniform Accounting perspective.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Throughout the pandemic, people moved to the suburbs where the cost of living is lower without a need to be next to a job.

While some may think that the pandemic and the way of life it brought is behind us, we are still feeling the lasting effects today.

Working from home is not going anywhere. A survey done in August 2021 in the US shows that 7 out of 10 businesses have permanently closed their office spaces during the pandemic.

Most of the employees will continue to look at their screens from the comfort of their homes, away from big cities.

This means that we will continue to see the effects of the At-Home Revolution, including the trend of moving out of cities and the higher demand for cars that come with it.

Rising demand is good for car manufacturers and first-hand dealers, but not so much when supply chain issues prevent companies from manufacturing at full capacity.

That is why people are going to the most viable option: used cars…

Copart (CPRT) has experienced it firsthand. It is a leading provider of online auctions and vehicle remarketing services with operations seen worldwide.

Through its Virtual Bidding Third Generation (VB3) platform, the company operates as an agent for the sale of vehicles to registered buyers anywhere in the world.

Sellers are generally insurance companies, but sometimes include banks, financial companies, and charities.

Copart was in a great position to benefit from the At Home Revolution and the increased demand for cars. However, the as-reported metrics make it seem like the pandemic did not impact the business at all.

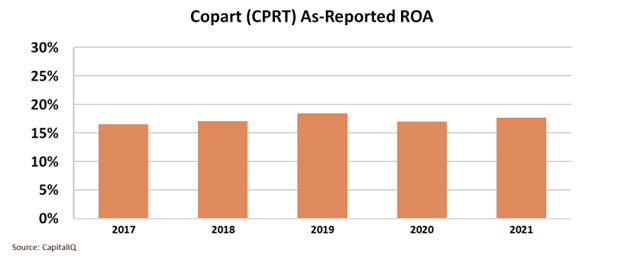

The as-reported return on assets (“ROA”) has been flat for the last 5 years, ranging between 17% and 18% and topping in 2019.

Looking at the as-reported metrics, investors may think that the company missed a huge opportunity to improve the business and increase sales.

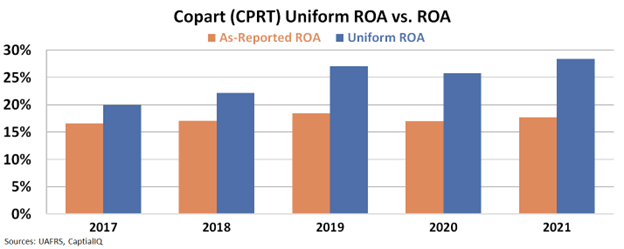

However, these metrics fail to show the real performance of the company. This is due to distortions in as-reported accounting and can be fixed by making the over 130 adjustments needed under Uniform Accounting.

In reality, Copart managed to boost its profitability successfully. Uniform metrics show that Copart’s ROA accelerated steadily after 2017, reaching all-time high levels in 2021.

Uniform ROA has risen from 20% in 2017 to 26% in 2020 and is now at 29% by 2021. These numbers show real acceleration.

Investors are looking at the wrong data and missing the actual growth of the company.

Without Uniform Accounting, Copart’s efforts to benefit from market trends and improve the business would go under the radar. While many investors are quick to write off trends from the pandemic, material impacts to profitability continue to remain apparent.

SUMMARY and Copart, Inc. Tearsheet

As the Uniform Accounting tearsheet Copart, Inc. (CPRT:USA) highlights, the Uniform P/E trades at 24.8x, which is above the global corporate average of 20.6x but below its own historical P/E of 26.9x.

High P/Es require high EPS growth to sustain them. In the case of Copart, the company has recently shown a 28% growth in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Copart’s Wall Street analyst-driven forecast is 13% and 7% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Copart’s $105 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 8% annually over the next three years. What Wall Street analysts expect for Copart’s earnings growth is well above what the current stock market valuation requires in 2022 but slightly below that requirement in 2023.

Furthermore, the company’s earning power in 2021 is 5x the long-run corporate average. Also, cash flows and cash on hand are over 14x its total obligations—including debt maturities and capex maintenance. All in all, this signals low credit risk.

Lastly, Copart’s Uniform earnings growth is above its peer averages and the company is also trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.