As obesity becomes a global problem, more people turn to companies that provide health and wellness solutions such as WW International (WW). Despite having robust returns due to its impressive brand and strong demand, credit rating agencies think that there is a 25% chance that WW will go bankrupt in the next five years. Today’s FA Alpha Daily will examine the company’s true credit risk.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Although we do not talk about it as much, obesity has become a global problem.

1.9 billion adults were overweight and 650 million of them were obese in 2016, nearly tripling since 1975.

As obesity becomes more frequent, so are the services that help battle it.

One company that provides such services is WW International (WW). Formerly known as Weight Watchers, the company offers weight management services such as its comprehensive diet program.

The core of its business model is a subscription-based program of support, but customers have access to a variety of purchasable products as well.

As WW International markets itself as a health and wellness brand rather than a weight-loss brand, its target audience is not only people with obesity but also those trying to live healthier.

Ironically, the company’s stock has not been the healthiest. It has been incredibly volatile as its valuation swings wildly from quarter to quarter.

This is due to the irrational behavior of its investors.

People tend to think any change in the company’s subscriptions is an indication of its permanent outlook going forward, but this is not the case.

Investors do not recognize the strong brand image and the impressive power the company has in the healthy living and weight management world.

As a result of impressive brand and demand, WW International has enjoyed remarkable profitability.

Its Uniform return on assets (“ROA”) has been above 50% every year for the past 15 years and a long time before.

Like many investors, the rating agencies are having a hard time understanding the business as well.

They rate a company with robust returns like WW International B+, thinking there is a 25% chance it will go bankrupt in the next five years.

Given high profitability and the company’s strong position in the industry, this rating makes no sense.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (CCFP) to understand the company’s obligations matched against its cash and cash flows.

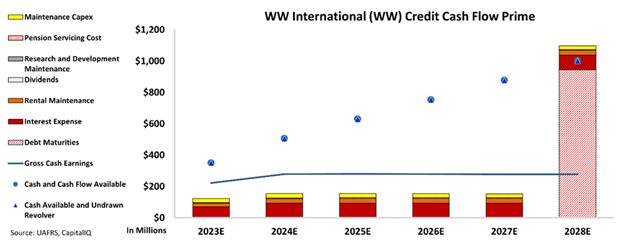

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The following chart proves that WW International has a much safer credit profile than what the credit agencies have been suggesting.

The CCFP shows that the company’s cash flows consistently exceed obligations by nearly 50% a year for the next 5 years.

Additionally, there are no debt maturities until 2028, meaning there is ample time for the company to continue to build up cash to handle those obligations or refinance to spread out its debt load across multiple years.

Healthy cash flow buffers spell access to refinance as the company sees fit.

All these facts make the company worthy of an IG4 rating from Valens.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and WW International Tearsheet

As the Uniform Accounting tearsheet for WW International, Inc. (WW:USA) highlights, the Uniform P/E trades at 9.9x, which is below the global corporate average of 19.3x and its historical P/E of 13.4x.

Low P/Es require low EPS growth to sustain them. In the case of WW International, the company has recently shown a 5% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, WW International’s Wall Street analyst-driven forecast is for a 30% EPS shrinkage in 2022, and 23% EPS growth in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify WW International’s $7 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 21% annually over the next three years. What Wall Street analysts expect for WW International’s earnings growth is below what the current stock market valuation requires in 2022 but above in 2023.

Furthermore, the company’s earning power in 2021 is 13x the long-run corporate average. Also, cash flows and cash on hand are more than 3x its total obligations—including debt maturities and capex maintenance. However, the company has an intrinsic credit risk that is 1000bps above the risk-free rate. Overall, this signals a high credit and dividend risk.

Lastly, WW International’s Uniform earnings growth is well below its peer averages, but the company is trading in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of WW International (WW) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.