Independent Investor Offer

Secure Order Form

Get access to...

Have you ever heard a wealthy person say “I did it because I listened to Wall Street”?

We certainly haven’t.

No knowledgeable investor listens to what “the Street” has to say about stocks, because they know that the street’s analysis is both biased and flawed.

Why biased?

Recent research shows 55% of S&P 500 stock ratings are “Buys”, 38% are “Holds”, and just 7% are “Sells”.

How can only 7% of stocks be worse than average? Shouldn’t that number be closer to 50% by definition?

Certainly that would be the case if the goal of these analysts was to be “right”. Even after rules and regulations around banking changed, the goal of Wall Street analysts still isn’t to choose the right stocks; it’s to generate revenue.

And to generate revenue, they need to keep their real clients happy.

And you’re not one of those clients. It’s the companies themselves.

-

Look at ENRON for example - one of the largest and most well-known corporate fraud cases in history. When things started to go south, when shares started to plummet from $90 all the way to $0... there were zero sell recommendations from Wall Street.

Zero.

And this was by no means a hidden or undercovered name. Enron had, at its peak, a $70 billion market cap and over 15 analysts following its every move. No way unbiased research by a whole slew of knowledgeable analysts would have led to that same conclusion.

This is because you're not the real customer - Enron is. The banks would have lost the lucrative debt issuing from Enron’s fall if they had given the first sell recommendation.

Not only is Wall Street research biased, but it is also incredibly flawed.

Why?

Because Wall Street focuses on traditional metrics derived from as-reported accounting figures.

As-reported data that:

- Warren Buffett has called “not representative of what’s going on in the business.”

- Seth Klarman said, “can mislead investors as to the real profitability of the business.”

- Marty Whitman said, “isn’t truth or reality.”

Data the best investors of this generation know to be garbage.

Wall Street uses unreliable, unrealistic, unusable data to produce research every day. How can that be trusted to support good investment decisions?

How would clients feel if they knew their portfolios were in the hands of stewards using bad data? Would they stick around?

For you to consistently beat the market you need to break away from traditional, Wall Street, as-reported-based research.

And Independent Investor is the solution to that need.

Imagine generating alpha for your portfolio using ideas unique from anything you’re hearing elsewhere.

Imagine having an answer for those tough questions about investing strategy and the markets that your family, friends, and colleagues ask... and that maybe you’ve been asking yourself for years.

Independent Investor can give you those unique insights and help you in the search for market-beating returns.

Independent Investor is powered by Valens Research... the research team behind the data and reports used by more than half of the 300 largest investment managers in the world, including each of the top ten.

Every month you will get answers to the toughest questions being asked about the US markets, with insights only available to the largest money managers in the world. You’ll also get one of the research team’s favorite stocks each month, as well as 50 other top-screening ideas.

Your subscription will give you access to two special monthly reports:

- FA Alpha 50 - our proven, market-beating stock recommendations, utilizing some of the most advanced analytical investment tools ever created to generate ideas like:

- Apple, before it went up 17x

- NVR before it rose 300%

- Universal Display, before it appreciated 400%

- Medpace, up 500%

- Fox Factory, up 400%

And more...

- FA Alpha Pulse - our systematic analysis of where we are in the current macroeconomic business cycle with uncanny insights into the state of the stock market and broader US economy - used by the world's top investment managers for asset allocation and tactical decision making.

- This is built off the same framework that got Valens Research clients to buy the bottom in March 2020...

Generating alpha and making a good macro call by itself may not seem unique. What is unique is the consistency of our approach and results, and the unparalleled power of the data that underpins our analysis.

Data that some of the largest hedge funds in the world have tried to replicate by spending millions of dollars on accounting thought leaders and massive teams of analysts.

At Valens Research, we use Uniform Accounting™ to correct over 130 errors inherent to GAAP Accounting. This allows us to uncover the true profitability of a company. And it’s been applied systematically for a universe of over 25,000 names.

With these errors corrected, investors can see the real earnings, real balance sheet, and real valuations of companies in which they invest. Only with the real economic picture in hand can quality fundamental analysis begin.

Our research is read by tens of thousands of investors and executives every week. More than half of the world’s 300 largest investment management firms read our work. All of the top ten global money managers read research based on Uniform Accounting™.

It is no coincidence that the best of the best trust our analysis.

Valens Research is unbiased, and unencumbered by terrible as-reported accounting requirements. And possibly most importantly, this foundation has led to results.

The FA Alpha 50 process didn’t just find the five ideas above, it also gave us:

- The Trade Desk, before it went up 13x

- MSCI before it jumped 16x

- Arista Networks before it went up 400%

Our institutional clients got our buy recommendation on Facebook before it went up over 10x over the next ten years. Our idea Forest Labs jumped nearly 200% in just over a year after we recommended it. It isn’t just a few great picks; it’s a consistent process that generates results.

This consistent process doesn’t just apply to stock picks either. It applies to the macroeconomic process we follow to bring you the FA Alpha Pulse.

- This process told our clients to watch out for a dip in late 2019. More importantly, it told clients to buy in March 2020.

- It also uncovered a possible slowdown in late 2018 before the market rolled over, but also highlighted that any market contraction would be a buying opportunity... before the market jumped 30%+ again in 2019.

And all of our unique processes and tools are available to Financial Advisors, today. The results of 100+ analysts applying the Uniform Accounting approach to stock picking and macroeconomic research, packaged together in a special subscription, with a 30-day money-back guarantee.

Independent Investor is the ultimate research package that will change the game for you.

It combines the financial insights of two coveted monthly reports, FA Alpha 50 and FA Alpha Pulse under one subscription.

FA Alpha 50 provides a screen of some of the best 50 stock ideas, as well as one highlighted analyst-recommended stock every month, by using the Uniform Accounting™ principles that are followed by top investment managers.

By screening for names on Quality, Growth, and Valuation metrics across a universe of over 5,000 names, the FA Alpha 50 screen cuts through the noise to deliver companies with strong fundamentals and inexpensive valuations.

FA Alpha Pulse brings together hundreds of different macroeconomic data points to distill the health of the overall economy into an easy-to-read diagnosis.

This is done by providing a comprehensive analysis of the key economic indicators beginning with the overall credit health of the economy, which is the catalyst for every prolonged recession over the last 100 years.

This value is unprecedented. You will receive both monthly stock picks and macro analysis for the price of 2 cups of coffee per month.

You can’t generate alpha by doing what mainstream financial media says - be unique with FA Alpha...

FA Alpha 50

Today, investors around the world use thousands of factors and data points in their search for alpha.

However, generating alpha by using traditional accounting data is typically not feasible because GAAP and IFRS mask the true quality and value of stocks.

We created FA Alpha 50 with the same data and analysis that has led to exceptional returns. Data that accurately reflects the true performance and valuations of companies.

Through this subscription you will get:

-

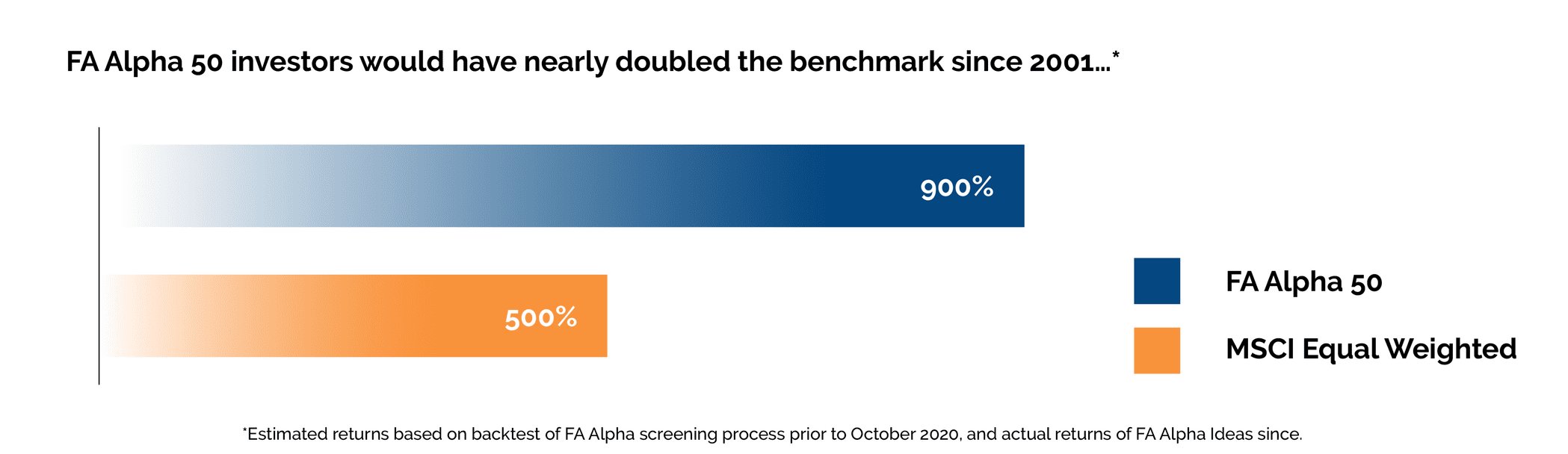

A product that has delivered market-crushing returns... with a portfolio based on this list of 50 stocks beating its benchmark by 400% since inception...

While the MSCI Equal Weighted Index has generated a 500% return over the past 20 years, FA Alpha 50 stocks have nearly DOUBLED that.

-

One great analyst-selected stock pick each month, pulled from the proprietary screen of 50 top ideas, with the fundamental thesis that could make it a major winner

Great data with no underlying story is nearly impossible to execute on, and makes it incredibly difficult to gauge when a thesis has run its course or has failed to follow through.

Conversely, a great story with no supporting data is a recipe built for investment failure.

Stock recommendations should be justified with great data and a great story.

FA Alpha 50 provides both.

Armed with the latest insights that only the top investment firms have – and that the mainstream media totally misses – you could be the center of the next business luncheon or coffee discussion.

FA Alpha 50 can bring you the stock picks that will make a difference for your portfolio just as the recommendations from our previous reports have done for our existing readers:

By following our insights, they’ve made returns like these:

- 500%+ on Lam Research from recommendation to close

- Over 300% on Cirrus Logic

- Another 290%+ on Winnebago

- Nearly 170% on Sonos in under a year

- And upwards of 250% on SolarEdge in just 9 short months!

Wall Street’s stock picks can’t be trusted. The Street isn’t incentivized to bring stock market investors the highest returns.

And mainstream financial media makes their picks on sensationalist-driven news. They typically cover a stock only after it has spiked, when it is already far too late to make a healthy return.

Be in the know, and use the same tools and analyses the largest investment firms rely on to make money for themselves and clients.

FA Alpha Pulse

It’s been said that the four most expensive words in investing are “this time it’s different.” And yet the mainstream financial media seeks to make every daily stock market movement look like the end-all, be-all of the economy.

Meanwhile, Wall Street’s strong bias toward its corporate clients leaves their recommendations about the markets worse than having nothing at all.

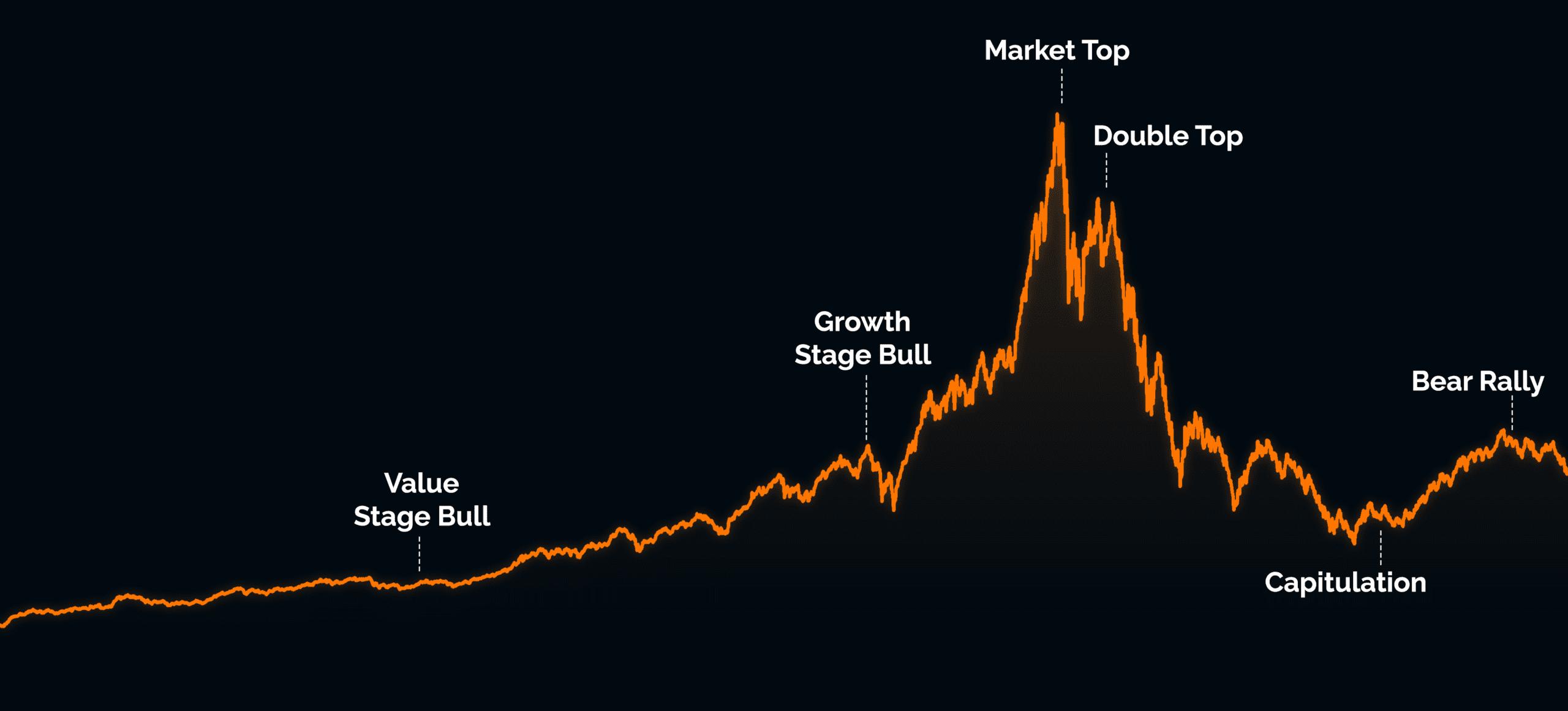

Where are we really in the current bull or bear market cycle?

How should you allocate assets? Stocks, bonds, or should you be parked in cash?

Wouldn’t it be powerful to have the perspective of more than 200 years of market research at your fingertips to share with clients and colleagues?

The ultimate goal of FA Alpha Pulse is to give you the final word on how to invest in the current investment environment and help your clients improve their investment allocation decision-making process.

This is done by providing a comprehensive analysis of key indicators and summarizing multiple complex factors into a format that can be quickly and easily understood.

FA Alpha Pulse digests a plethora of various macroeconomic data points and key contextual information and categorizes it into 4 key pillars of market health: credit health, corporate growth, investor sentiment, and market valuations.

Through this monthly subscription, you will receive:

- Highlights from Valens Research’s Market Phase Cycle, our comprehensive macroeconomic report that has been assisting many of the world's largest and greatest investors with uncanny market analyses and projections

- A Chart of the Month that hands you a unique perspective on the state of a key economic metric and its impact on the markets

- The Timetable Investor asset allocation guideline that provides you with a strategy to get ahead of the media and Wall Street and position your portfolio allocations alongside the world's best investors

We break down credit, equity, and macroeconomic signals to give you what historically only the top investment firms could afford to analyze.

FA Alpha Pulse gives you a clear vision into the state of the current market and how best to navigate it – helping you improve your financial insights and saving you significant time.

Readers of our unique, non-consensus macroeconomic reports were able to position themselves better during the pandemic.

When the whole market was panicked about further downside, we hunkered down and told our clients to seize the buying opportunity, calling a bottom that soon led to a massive turnaround, and making our clients more back than they lost during the brief recession.

Our systematic approach to understanding the market helps us avoid the emotional impulses that cause so many to damage returns and buy when high and sell when low.

This in turn can help you ignore the noise of Wall Street analysts and sensationalist financial media outlets. Gain conviction in your allocation decisions, and be in the prime position to make the right call.

Starting this month, you will no longer need or even want to read anything from Wall Street.

You’ll get to see one great stock pick each month, complete with better data and detailed fundamental research.

And you’ll get monthly updates on the four core market signals, as well as up-to-date, unique macro insights to share with clients.