Drillers will be chasing a suddenly scarce commodity in the form of equipment, services, and labor with rising oil prices. Today’s FA Alpha Daily will explore ChampionX (CHX), a supplier of key components and services for oil drillers, and what credit rating agencies miss.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

As we talked about recently with Weatherford (WFRD), U.S. oil production is seeing a renaissance.

After almost a decade of low oil prices, market prices have surged in recent months as supply chain challenges, coupled with Russia’s invasion of Ukraine, have severely hampered the oil supply.

The result of these geopolitical flashpoints is that high oil prices are inevitably going to lead to a kick-off in wildcat drillers who have been holding off the past few years to finally cave in and spend on capital expenditures.

However, just because these drillers are seeing increased oil prices does not mean that they will suddenly become winners.

Rather it means they are all going to be chasing a suddenly scarce commodity, in the form of equipment, services, and labor, which will lead to surging prices.

Interestingly, while equity markets and credit rating agencies aren’t picking up on the tailwinds this business is seeing, Wall Street analysts are.

Companies like ChampionX (CHX) are forecast to see ROA rebound from 7% in 2020 to 16% levels in 2021. That said, credit rating agencies are still missing the picture. For example, S&P gives the company a BB rating, which indicates a greater than 10% chance of default in the next five years.

However, we can figure out if there is a real risk for this cash-rich company by examining it through the lens of the Credit Cash Flow Prime.

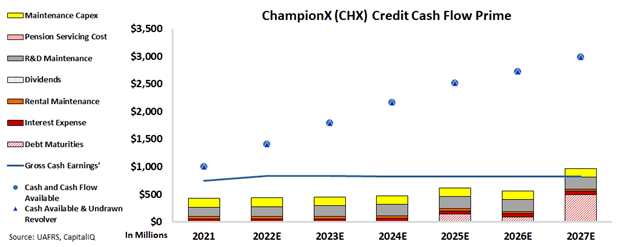

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Even if we were to ignore the massive industry tailwinds making this default unlikely, a look at the CCFP shows why such a low rating makes no sense.

Not only does ChampionX have high levels of cash on its books and cash flows that exceed obligations every year until 2027, but it also has no debt maturities on its balance sheet for the next few years.

Combined, we are left with a company that is facing a very low risk of bankruptcy and has a significant cash buffer even if there were a minor disruption at any time.

See for yourself:

As we mentioned though, rating agencies are not recognizing this recovery, as ChampionX is still priced as a high yield credit with a BB rating.

That’s why we rate ChampionX as a much safer IG3+ investment-grade credit, and with the continued fundamental tailwinds, the recovery could be even stronger.

ChampionX is yet another company where the credit rating agencies don’t capture the complete story. While we at Valens recognize the flaws with traditional credit ratings, many creditors do not. The BB credit rating is pessimistic and paints a picture of a company that is much riskier than it is in reality.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and ChampionX Corporation Tearsheet

As the Uniform Accounting tearsheet for ChampionX Corporation (CHX:USA) highlights, the Uniform P/E trades at 11.2x, which is below the global corporate average of 24.0x, and its historical P/E of 15.5x.

Low P/Es require low EPS growth to sustain them. That said, in the case of ChampionX, the company has recently shown a 47% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, ChampionX’s Wall Street analyst-driven forecast is for a 171% and 13% growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify ChampionX’s $25 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 16% over the next three years. What Wall Street analysts expect for ChampionX’s earnings growth is above what the current stock market valuation requires in 2021 but below in 2022.

Furthermore, the company’s earning power in 2020 is above the long-run corporate average. Moreover, cash flows and cash on hand are almost 3x its total obligations—including debt maturities and capex maintenance. However, intrinsic credit risk is 160bps above the risk-free rate.

All in all, this signals a low dividend risk.

Lastly, ChampionX’s Uniform earnings growth is well above its peer averages, and the company is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of ChampionX’s credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.